Insight

September 2025

10c-1a FAQ

SEC Rule 10c-1a Frequently Asked Questions

Introduction to 10c-1a

1. What is the purpose of SEC Rule 10c-1a?

This rule aims to increase transparency in the securities lending market by requiring covered persons to report the material terms of their securities lending transactions to FINRA.

2. When does the rule come into effect?

The original compliance date for 10c-1a was January 2, 2026.

However, on April 29th, 2025, FINRA formally submitted a request to the U.S. Securities and Exchange Commission (SEC) requesting an extension of the compliance date to the Rule 10c-1a, which requires covered persons to report covered securities lending trades to the authority.

On July 28th 2025, the SEC formally extended the key compliance dates for market participants and FINRA to begin reporting under 10c-1a from September 28th, 2026. The start date for FINRA to publicly disseminate the collected data out to the public was also extended until March 29th, 2027.

3. What information needs to be reported?

Covered persons must report covered securities loans and details for the reportable securities, including loan start and end dates, quantities of securities loaned, interest rates, fees, collateral details and counterparty information.

4. How often do I need to report?

The final rule requires end-of-day reporting by the trade date to a designated Registered National Securities Association (RNSA), currently FINRA.

5. What is SLATE?

SLATE (Securities Lending and Transparency Engine) is the platform that FINRA plans to implement for the reporting of securities lending transactions under 10c-1a. SLATE will operate alongside other FINRA transaction reporting platforms such as CAT (Consolidated Audit Trail).

What did the Fifth Circuit Court decide about Rule 10c-1a on August 25, 2025?

Background

The SEC adopted two related rules in October 2023:

- Securities Lending Rule (Rule 10c-1a) – requires near real-time reporting of securities loan transactions to FINRA and public data dissemination.

- Short Sale Rule (Rule 13f-2) – mandates monthly, aggregate disclosure of short sale activity via EDGAR.

Petitioners’ Challenges

Industry groups challenged both rules, claiming:

- The SEC exceeded its authority under Dodd–Frank.

- The rules were arbitrary, capricious, and lacked sufficient public comment.

- Reporting requirements conflicted with each other, particularly emphasizing that securities lending data overlapped with short sale activity.

Courts’ Key Findings

- Authority Under Dodd–Frank

- The court found that the SEC’s adoption of the Securities Lending Rule was valid under § 984(b), distinct from the Short Sale provisions (§ 929X). The SEC did not exceed its statutory mandate.

- The SEC properly considered public input and responded to concerns about frequency and data exposure.

- Interplay Between Rules

- Although the rules overlap (securities loans often underpin short sales), they address distinct regulatory purposes.

- The court upheld the SEC’s rationale that aggregate data, delayed loan-size reporting, and differentiated thresholds were sufficient.

- Economic Impact Analysis

- The court agreed with petitioners that the SEC should have analyzed the cumulative economic impact of both rules together, given their related nature and simultaneous adoption.

- The failure to do so violated the Administrative Procedure Act (APA) and statutory requirements under the Exchange Act.

Conclusion

- The court granted the petition in part and remanded both rules to the SEC, requiring additional economic analysis of their combined impact.

- All other challenges were denied.

Summary Table

Issue | Court’s Ruling |

Statutory authority to adopt rules | Upheld — valid under Dodd–Frank provisions. |

Overlap between lending/short sale rules | Upheld — distinct purposes justify differences in reporting scope and timing. |

Economic impact consideration | Vacated remand required — SEC must assess cumulative economic effects. |

Key Definitions

1. Who are considered “covered persons” under the rule?

The rule applies to broker-dealers, agent lenders and certain other participants involved in securities lending transactions.

Any person that agrees to a covered securities loan on behalf of a lender or as a lender is considered a covered person.

This includes, but is not limited to, broker-dealers, agent lenders and certain other participants involved as lenders in securities lending transactions. Additionally, broker-dealers are also considered a covered person when borrowing fully paid or excess margin securities.

2. What is a Covered Securities Loan?

A covered securities loan is a transaction in which any person on behalf of itself or one or more other persons lends a reportable security to another person.

3. What constitutes a Reportable Security?

A reportable security is considered any securities reportable under Consolidated Audit Trail (CAT), Trade Reporting and Compliance Engine (TRACE) or Real-Time Transaction Reporting System (RTRS). These can be understood broadly as any securities denominated in USD or securities that settle in the U.S.

4. What is the jurisdiction of 10c-1a reporting?

The SEC is of the view that the rule’s reporting requirements will generally be triggered whenever a covered person effects, accepts or facilitates (in whole or in part) in the U.S. a lending or borrowing transaction.

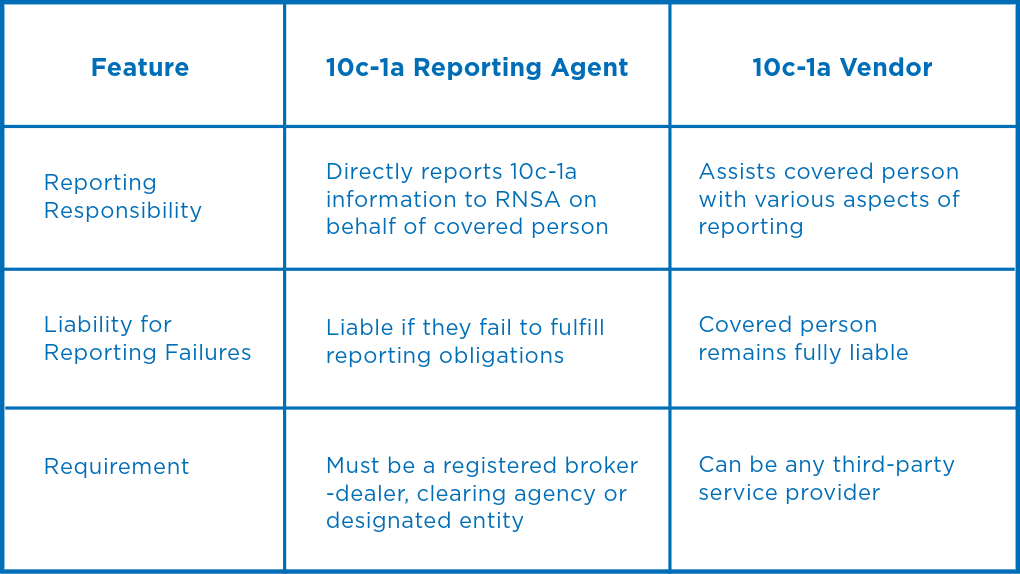

5. What is the difference between a 10c-1a vendor (also known as a service bureau) and a 10c-1a reporting agent?

6. What are the main exemptions or exceptions to 10c-1a reporting requirements?

Most securities lending transactions are covered, but key exceptions include:

- The use of margin securities by broker-dealers (except when the broker or dealer lends such margin securities to another person).

- Positions resulting from clearing services.

- Repurchase agreements (repos), which are specifically out of scope.

7. What are the key dates for 10c-1a reporting?

10/13/2023

Regulation Release

1/2/2024

Final Rule 10c-1a Becomes Effective

5/1/2024

FINRA Implementation Proposal

8/5/2024

SEC Action on FINRA Requirements

1/2/2025

FINRA Proposed Rule in Effect

7/1/2025

FINRA UAT Period Opens

28/9/2026

Regulation Go-Live

29/3/2026

FINRA begins to publicly disseminate collected data

Implementation

1. Do I need to report modifications to existing trades?

Yes, the rule requires reporting both new and modified loan agreements with the timestamp of when the new trade and modifications occurred. Pre-existing trades (pre-Jan. 2, 2026) including terminations of pre-existing trades, should be reported with the latest terms of the trade the first time after Jan. 2, 2026, that a modification to that trade appears.

2. What is the process for reporting modifications and corrections in SLATE?

- Modification Events: Reporters must submit only the modified fields required to be submitted, along with key linkage fields and the date and time of modification.

- Correction Events: Reporters must submit only the updated fields required to be submitted, in addition to key linkage fields.

3. What format is required for reporting modifications and corrections in SLATE?

FINRA customers can upload files via SFTP, REST APIs over HTTPS protocol or through AWS S3 APIs.

In-scope firms should become familiarized with the rule’s requirements and begin exploring solutions to streamline data collection and reporting. Consider technology solutions like EquiLend’s platform designed to assist with 10c-1a compliance.

In-scope firms should register with FINRA to obtain an MPID (market participant Identifier) value.

The SEC website (https://www.sec.gov/news/press-release/2023-220) provides access to the final rule text, FAQs and other resources. Additional information can be found at the FINRA website https://www.finra.org/filing-reporting/slate. You can also stay informed by attending industry webinars and conferences and engaging with industry associations. Make sure to visit our webpage at https://equilend.com/services/sec-rule-10c-1a/ for a side-by-side comparison between 10c-1a and SFTR, key dates for 10c-1a reporting, exclusive insights and more.

If a loan event happens before 7:00 p.m. on a business day (Day T), it must be reported that same day before the system closes. Events after 7:00 p.m. aren’t due until the following business day. For transactions that take place on weekends, holidays, or any day SLATE is unavailable, reporting must occur on the next available business day during operating hours.

11. How should previously reported events be linked in SLATE?

The updated event linkage table specifies which elements should be used to link previous events, depending on the message type and reporting day. The introduction of “fileRecordId” and “parentFileRecordId” helps ensure accurate sequencing and linkage, especially for corrections or cancellations where a FINRA Control Number has not yet been assigned.

12. What are “Optional” and “Voluntary” data elements in SLATE reporting?

- Optional: Additional clarification provided; should be reported where applicable.

- Voluntary: New value introduced; can be reported but will not be disseminated.

13. How can firms determine if a security is reportable under 10c-1a?

FINRA is expected to publish a list of SLATE reportable securities with addendums multiple times a day. However, if the security in question falls into the CAT, TRACE or RTRS universes and is not on the SLATE list of eligible securities, it is the responsibility of the covered person to request the addition of that security to the list and report the trade to FINRA.

Firms should assess whether a security falls into one of three categories:

- Securities reportable to the Consolidated Audit Trail (CAT), including listed equities, listed options, and OTC equity securities.

- Debt securities reportable to the Trade Reporting and Compliance Engine (TRACE).-

- Municipal debt securities reportable to the Real-Time Transaction Reporting System (RTRS).

14. Where can I find the FINRA Technical Specifications?

FINRA Technical Specifications can be found at https://www.finra.org/sites/default/files/2024-05/slate-participant-specification.pdf

15. What are the key updates in FINRA’s June 2025 release of the SLATE specification v1.2?

- Updates to field formats, data lengths, and naming conventions

- Additional collateral type and currency options, including mixed and uncollateralized loans

- Initial domain values for benchmarks

- Refined guidance on reporting timelines and data submission

- Additional clarity on handling corrections, cancellations, and errors

- Sample JSON files provided showing expected input/output values to/from FINRA

16. Given the 5thcircuit ruling and the statement by the SEC on September 5th, what can we expect for an implementation timeline for 10c-1a?

While the 5th circuit ruling remanded the 10c-1a requirement back to the SEC for further economic impact analysis, the 5th circuit did not find the regulation itself to be in error. In SEC’s statement on September 5th, Paul Atkins directed the SEC “to evaluate the rules in light of the opinion and make recommendations for appropriate Commission action, including potential changes to the rules and adjustments to the related compliance dates”. Until such point in time where the SEC makes further announcements, the current regulation stands, as does the current implementation date.

What are the benefits of using EquiLend to support your reporting requirements?

1. Seamless integration with existing EquiLend products to leverage transaction and position data (OneFile, SFTR, Spire, etc.), existing processes and more.

2. User-friendly dashboard to manage reporting & exception handling

3. Continually delivering quality regulatory products with timely updates when revised regulations are published

For any clients still interested in joining our 10c-1a working group, please get in touch with us at RegTech@equilend.com or speak to your client relationship manager.

This FAQ is intended to be informative and does not constitute legal advice. Please refer to the official SEC rule text and consult with legal counsel for specific questions and guidance on compliance.