The EquiLend SFTR Solution

Ensure regulatory compliance for your Securities Financing Transactions Regulation (SFTR) reporting obligations with EquiLend’s flexible SFTR solutions. EquiLend’s 20 years of expertise in securities finance industry technology enables us to offer SFTR solutions designed and tailored specifically to support our clients with their SFTR reporting.

EquiLend operates NGT, the securities finance industry’s most active trading platform, and a full suite of widely used post-trade comparison services, including the flagship Unified Comparison tool. This makes EquiLend ideally placed to offer a point-of-trade solution to support firms trading either principal to principal or principal to agency.

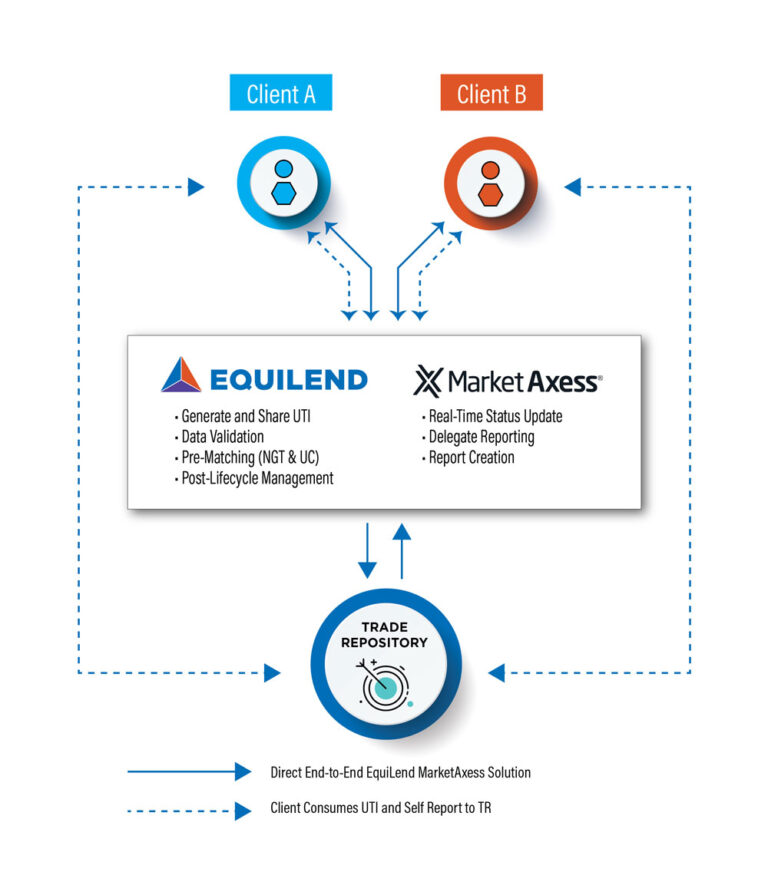

EquiLend and MarketAxess have additionally teamed up to offer a full STP solution from point of trade straight through to the trade repository of a client’s choice, allowing firms to obtain a pre-repository match, ensure accurate reporting and efficient exception management processing.

Solutions

Not all firms are alike, and SFTR solutions are most certainly not one-size-fits-all. Depending on your firm’s needs, we offer a stand-alone solution and an STP option through our partnership with MarketAxess.

-

EquiLend SFTR

Utilizing our own proprietary trading and post-trade systems, NGT and Unified Comparison, EquiLend SFTR offers clients full SFTR support with UTI generation and execution time stamp at point of trade, in addition to full lifecycle management, including loan and collateral allocation data sharing. EquiLend pre-matches client data, ensuring greater accuracy in each client’s reporting. Data is compared ahead of submission to the respective trade repository (TR), securing an optimal match rate for TR reconciliation and a more efficient settlement process.

-

EquiLend & MarketAxess SFTR Solution

Where further data enrichment or reporting requirements are necessary, we recommend our preferred SFTR partners, MarketAxess. The MarketAxess Insight engine captures and centralizes reporting flows, enabling firms to manage exceptions through a single interface and to rely on the MarketAxess rules engine to filter and enrich trades. Clients additionally may use the MarketAxess delegated reporting offering, where MarketAxess will submit completed SFTR reports to the trade repository on behalf of the client firm. With the combined services of EquiLend and MarketAxess, firms can achieve true STP from the point of trade straight through to the trade repository—a virtually no-touch SFTR solution.

Benefits

-

ESMA-compliant UTI and execution timestamps auto-generated and shared at point of trade, the earliest stage for SFTR reporting

-

Loan allocations shared at point of trade, providing UTI and execution timestamps on underlying principal funds and beneficial owners

-

100+ trading client base, offering maximum access to the securities lending and repo community

-

A fully automated front-to-back SFTR reporting solution: trades booked on NGT can be subsequently auto-enriched via SFTR Insight with relevant data fields and reported within minutes to the trade repository

-

Reconciliations on trades show an average break rate of less than 1% across the lifecycle for transactions executed on NGT versus a 35% break rate for transactions executed off platform

What is SFTR?

SFTR applies to securities financing transactions (SFTs) made with European entities. As a measure to increase transparency in SFTs, the regulation requires all firms subject to SFTR to report a range of matched, verified fields to a trade repository from which the regulator can access and analyze this data.

The SFTR reporting requirement went live July 13, 2020, for banks, broker-dealers, exchanges and CCPs, with buy-side firms required to begin reporting in October 2020.

Kevin McNulty

Head of RegTech Solutions

+44 (0) 203 023 8394

Iain Mackay

Product Owner, RegTech Solutions

+44 207 426 4402