Insight

August 11, 2025

Market Flash

Market Flash: Baxter International Inc. (BAX)

Bearish Sentiment on Baxter (BAX) Intensifies After Guidance Cut and Voluntary Product Pause, Following Earlier Class I Recall

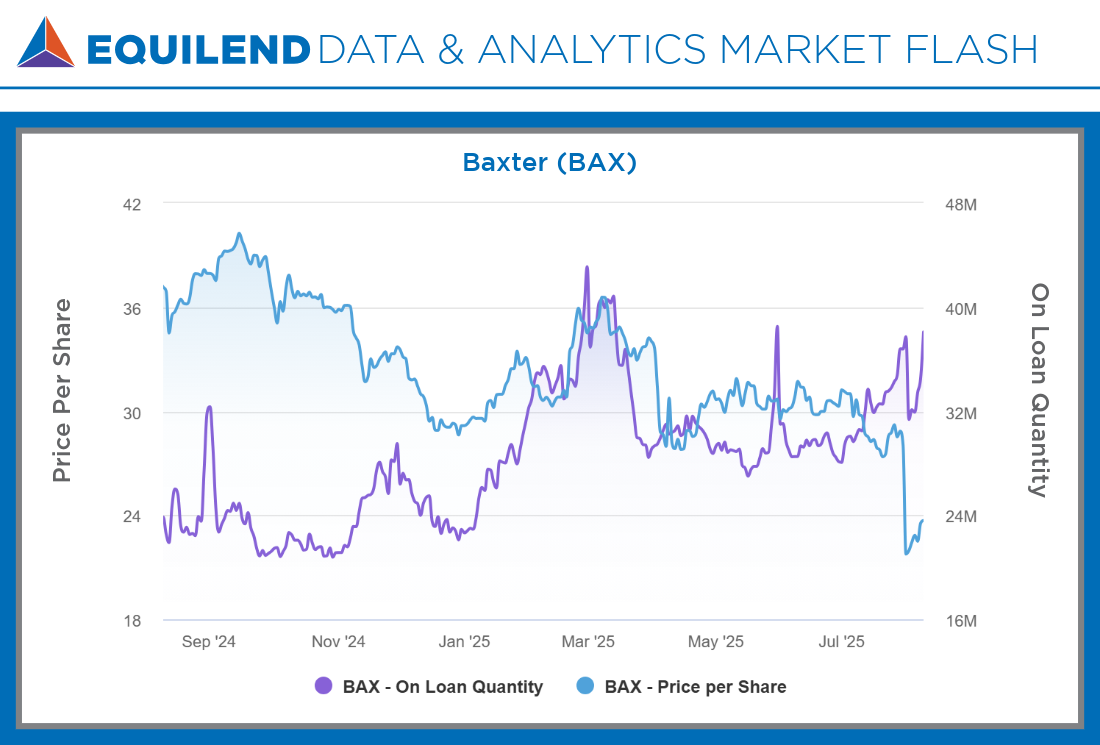

In our latest EquiLend Data & Analytics Market Flash, we analyze the multi-month build-up of short interest in Baxter International Inc. (BAX). This trend appears to have been initiated by a serious product recall announced on May 30 and has now entered a new, more volatile phase following a disappointing Q2 earnings report on July 31, which included a downward revision to full-year guidance.

Market Context

The negative sentiment surrounding Baxter did not begin with the recent price decline. The foundation for a bearish thesis was laid on May 30, 2025, when the company initiated an Urgent Product Recall for its mobile lift component. The FDA subsequently classified this as a Class I recall, its most serious level, noting the product defect was associated with three serious injuries and one death. This event created significant uncertainty around potential litigation, remediation costs and reputational damage.

These pre-existing concerns were compounded on July 31, 2025, when Baxter reported weaker-than-expected Q2 revenue and lowered its full-year financial forecast. The company cited several factors for the guidance cut, including softer demand, operational pressures and lingering effects from Hurricane Helene. The guidance reduction appeared to validate the market’s earlier fears, leading to a sharp 22.4% decline in the stock price.

EquiLend Data & Analytics Insights

EquiLend’s securities lending data reveals a clear pattern of building bearish sentiment over the past three months, with distinct phases corresponding to major corporate events.

- Sustained Borrowing Trend: Shares on loan increased from 29.3 million in early May to 38.1 million currently, representing an 8.8 million share increase over the three-month period. The initial uptick began immediately following the May 30 Class I recall announcement.

- Post-Earnings Volatility: Following the July 31 guidance cut, we observed significant short covering with 2.6 million shares returned in the week after earnings, suggesting some participants viewed the 22.4% price drop as an opportunity to take profits rather than press bearish bets.

- Current Positioning: Despite the recent covering activity, shares on loan remain elevated at 38.1 million though borrowing costs remain stable.

Analysis

The sustained build-up in borrowing activity appears to have been initiated by the Class I product recall in May, as investors began pricing in significant operational and legal risks. Average shares on loan increased from 27.6 million pre-recall to 31.0 million in the period between the recall and earnings announcement.

The weak guidance and additional operational disclosures on July 31 may have served as a powerful confirmation of the bearish thesis. However, the subsequent short covering suggests the market may be finding equilibrium at current levels. The data indicates that while bearish sentiment remains elevated compared to pre-recall levels, the most aggressive positioning may have moderated following the significant price adjustment.

Book a demo of EquiLend Data & Analytics today to receive these signals and more in real-time: https://equilend.com/contact-us/.

Bloomberg Terminal users can subscribe to EquiLend’s exclusive short selling and financing data by entering terminal shortcut APPS ORBISA <GO> or clicking the following link: https://on.equilend.com/bloomberg-terminal-page.