Insight

August 21, 2025

Market Flash

Market Flash on Circle Inc (CRCL)

CRWV Lockup Sparks 44k+ bps Surge & CRCL May Be Next

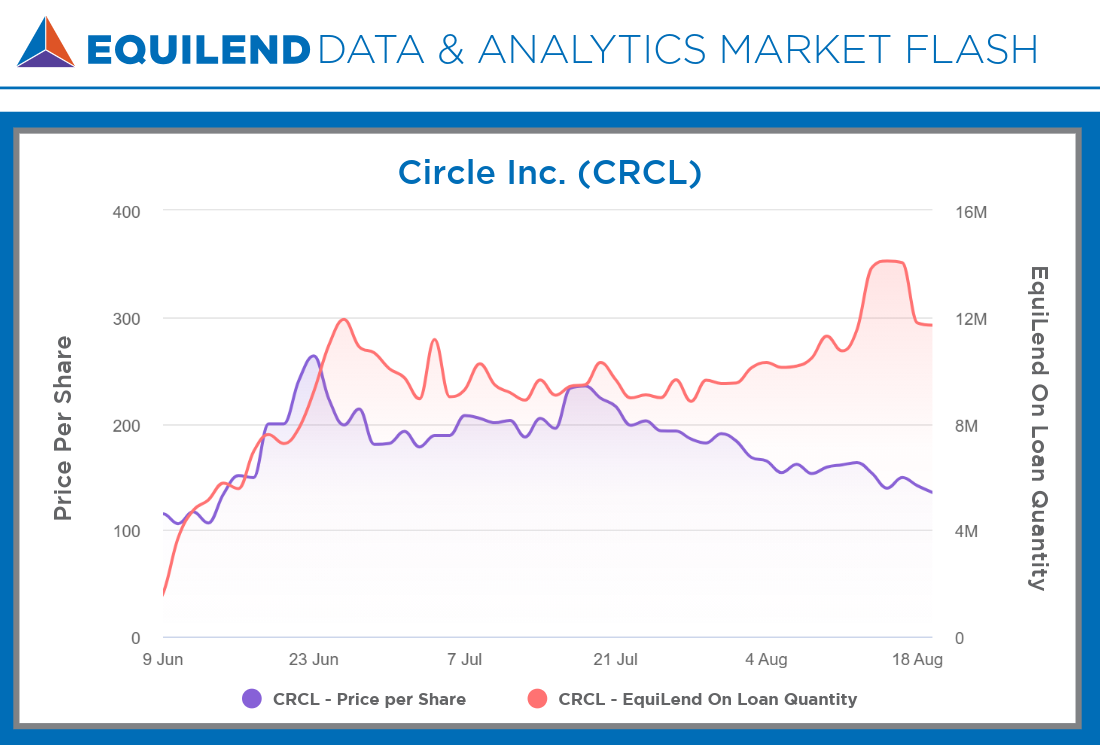

EquiLend Data & Analytics presents a comparative analysis revealing critical lockup dynamics in securities lending markets. CoreWeave (CRWV) demonstrated extreme volatility around its accelerated lockup expiration on August 14, 2025, with borrowing costs peaking at 44,324 bps before collapsing. CRCL exhibits similar pre-lockup warning signals with utilization remaining elevated, suggesting potential for comparable volatility. Daily monitoring of borrowing metrics is essential to stay ahead of lockup-driven supply shocks.

CRCL Early Lock-Up Already Activated

Our analysis reveals that CRCL has already triggered its early lock-up release provision, with J.P. Morgan releasing 11.5 million shares as of August 13, 2025. This development fundamentally alters the risk profile. The early release was triggered after the stock traded 15% above its IPO price for 5 trading days. The standard 180-day lock-up remains in effect for remaining insider shares.

This early release provides crucial context for current securities lending metrics. The still elevated utilization rate of 83% likely reflects short positioning for the remaining standard lock-up expiration. Limited lendable supply versus 11.8M on loan indicates that positioning is still heightened for the second wave of volatility around the future share release date. As CRCL undergoes these staggered lock-up releases, this creates multiple volatility events and with them, both opportunity and risk.

Lock-Up Analysis & Trajectory

CoreWeave’s recent share release gives market participants a possible roadmap for what to expect with respect to CRCL’s lockup coming to an end later this year. However, there are key differences traders should be aware of. CoreWeave experienced an accelerated lock-up expiration that occurred on August 14, 2025, more than a month before the initially scheduled release date for September 24. Borrowing costs spiked to 44,324 bps in the final days before the event. The stock declined 35% in two days as 83% of Class A shares became tradeable and supply flooded the market. Circle Inc., on the other hand, will experience a staggered release with the first, early release of 11.5M shares having already occurred. The standard expiration, when the remaining insider shares will get released, will occur either 2 days after the September 30 earnings’ report, October 2, or 180 days after the IPO date, December 2. Despite the difference in lockup expiration timing, the current securities finance metrics are mirroring what we saw with CRWV’s pre-lockup profile. Heightened utilization as the demand to borrow shares remains elevated. This is only exacerbated by the limited supply currently available to the broad market.

Risk Management & Action Items

Securities lending metrics indicate CRCL may be on CRWV’s pre-lockup trajectory. Market participants should prepare for potentially large daily moves around the next lockup event. The limited float creates amplified volatility risk. Monitor EquiLend data daily for changes in lendable supply, borrow demand and changes in borrowing metrics.

Conclusion

Securities lending data provides a unique and differentiated view into post-IPO share lockup dynamics. We saw this play out in the lead up and aftermath of Core Weave’s share release and we are starting to see similar patterns emerging around Circle Inc.’s impending share release. However, CRCL’s staggered, dual-lockup structure creates a more complex and potentially prolonged period of risk. With utilization levels elevated and a supply of shares available to borrow constrained by the lockup, the data suggests a heightened risk of significant price dislocation.

Market participants who monitor EquiLend’s daily data on utilization, fees and lendable supply can position themselves ahead of lockup-driven volatility events rather than reacting after they occur.

Book a demo of EquiLend Data & Analytics today to receive these signals and more in real-time: https://equilend.com/contact-us/.

Bloomberg Terminal users can subscribe to EquiLend’s exclusive short selling and financing data by entering terminal shortcut APPS ORBISA <GO> or clicking the following link: https://on.equilend.com/bloomberg-terminal-page.