Insight

September 9, 2025

Market Flash

Market Flash on Foot Locker (FL)

Borrow Costs Spike Ahead of $2.4B Merger

What’s in the News

The acquisition of Foot Locker by DICK’S Sporting Goods, valued at $2.4 billion, closed on September 8, 2025. The deal, which received overwhelming shareholder and regulatory approval, combines the two retailers to create a global leader in sports and footwear with a combined revenue of approximately $21 billion. Foot Locker will continue to operate as a separate entity within the larger DICK’S organization. This comes at the same time as Foot Locker is set to be replaced by United Parks & Resources in the S&P Small Cap Index.

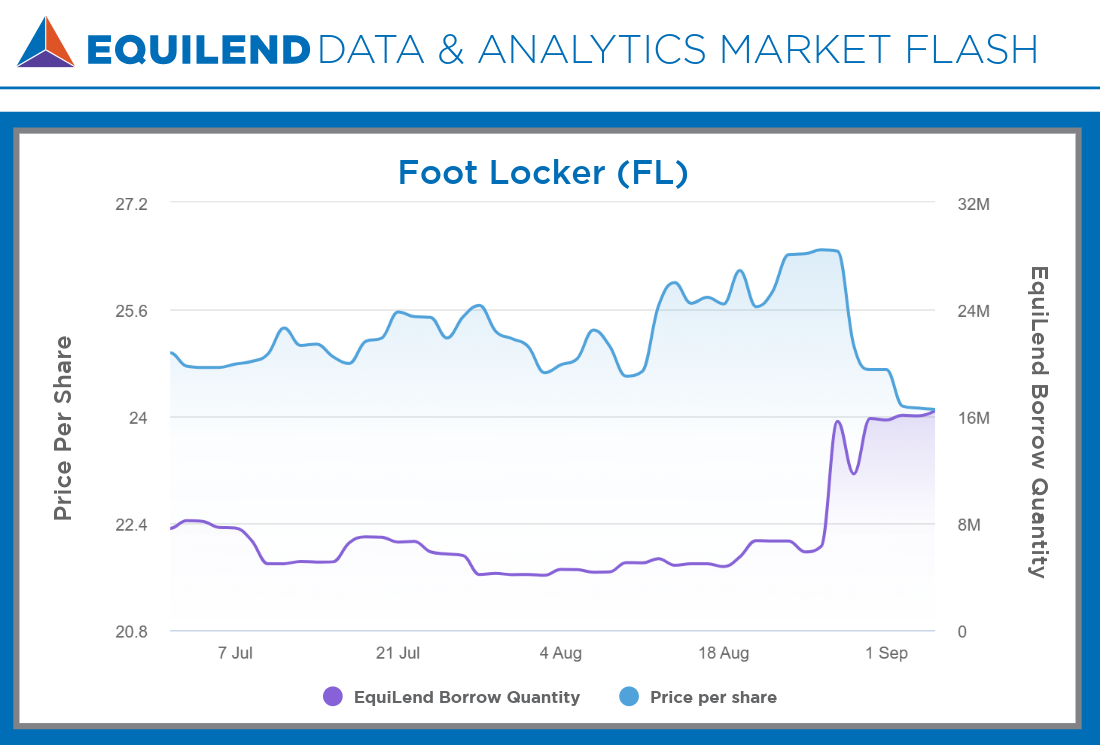

Borrow Balances More Than Doubled into September

EquiLend Borrow Quantity surged from 6.6mm shares on August 21 to 16.4mm by September 2. Net new borrowing activity added 9.3mm shares on August 27 alone, a sign of heightened attraction from borrowers for shares of Foot Locker stock. Moreover, we’ve seen a rise in shares on loan for DKS as well, with EquiLend’s Borrow Quantity up more than 1.8 million shares last week. EquiLend’s financing data is capturing merger arbitrage strategies at work in real time, as traders look to capture the spread between the current trading price of both securities and the implied value of the newly combined entity’s shares after the exchange.

Borrow Costs Spiked Sharply

EquiLend Cost of Borrow swung above 14,000bps, underscoring heightened pressure for arbitrageurs who must balance the premium they pay in fees vs. the potential payoff of the spread trade. After dropping back down to nearly 10bps on Thursday, fees surged again at to close last week reaching just above 900bps.

What Our Data Shows

EquiLend’s data shows Foot Locker shares continue to attract attention — swelling borrow balances, near-saturation of lendable supply, and high fees. Together, these highlight the arbitrage dynamics that are at play in the days leading up to the merger’s close on September 8.

The EquiLend Edge

EquiLend’s short sale & financing data provides actionable intelligence on evolving market sentiment that traditional metrics may not capture.

Book a demo of EquiLend Data & Analytics today to receive these signals and more in real-time: https://equilend.com/contact-us/.

Bloomberg Terminal users can subscribe to EquiLend’s exclusive short selling and financing data by entering terminal shortcut APPS ORBISA <GO> or clicking the following link: https://on.equilend.com/bloomberg-terminal-page.