Insight

Feb 6, 2026

Market Flash

Market Flash on Brand Engagement Network (BNAI)

AI Licensing Deal Drives Stock Up 277% Amidst Retail Chatter and Rising Short Interest

When a stock jumps by 277% in a single day, signals like EquiLend’s Short Squeeze Score and Short Interest metrics can react first. Having access to those signals is what separates the good investors from the great! In the case of Brand Engagement Network (BNAI US), users of EquiLend Data & Analytics certainly had access to those signals.

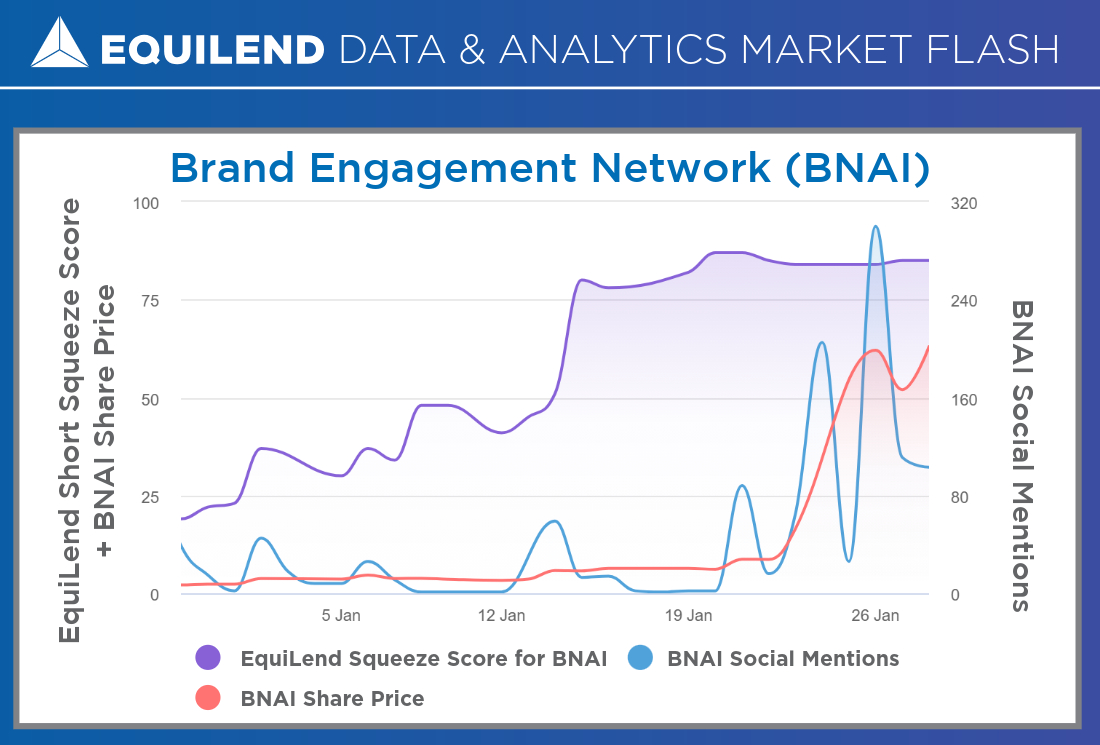

In the days leading up to BNAI’s 277% rise on January 26th, EquiLend’s Short Squeeze Score had already risen from 25 to 80. This was driven by rising short interest, positive price momentum, and most notably a rise in Retail Social Media activity in the name.

On January 14th and 21st EquiLend saw Social Media activity spike by more than 4x and 5x the 30-day rolling average, respectively. Then on January 24th, a Saturday, social media activity jumped by more than 10x the 30-day average setting the stage for the surge the following Monday. On that day, the immediate buying pressure from the retail market coupled with high squeeze risk saw the stock go from $16.48 to $62.08.

With access to EquiLend’s leading Data & Analytics, investors were able to see the signs and align their portfolios before the market open. Be sure to reach out to EquiLend now to start a free trial or how to customize alerts for these signals!

The EquiLend Edge

EquiLend’s short sale & financing data provides actionable intelligence on evolving market sentiment that traditional metrics may not capture.

Book a demo of EquiLend Data & Analytics today to receive these signals and more in real-time: https://equilend.com/contact-us/.

Bloomberg Terminal users can subscribe to EquiLend’s exclusive short selling and financing data by entering terminal shortcut APPS ORBISA <GO> or clicking the following link: https://on.equilend.com/bloomberg-terminal-page.