Insight

November 2021

Keith Min

Emerging Trends in Securities Finance

Securities lending activity thus far in 2021 has been eventful with meme stocks, SPACs, corporate events and other drivers increasing revenue up to pre-pandemic levels. ETFs have also seen an increase in revenue as a high–yield corporate bond ETF, HYG, regularly visited the monthly top earners. But comparing 2021 with a year fraught with everything from short selling bans to a lack of specials from a securities lending perspective, may not represent where the industry is heading. Join DataLend as we compare key differences in Q3 of 2021 to 2020 and 2019 to identify a few emerging trends that can shape the coming months.

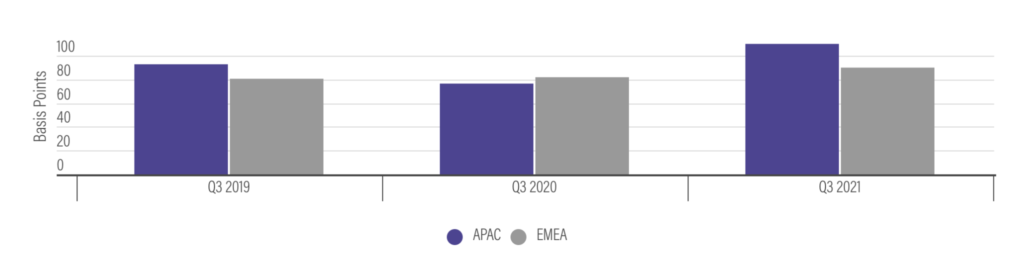

Fees Surpassing Pre-pandemic Levels in EMEA and APAC

While North American equities experienced the largest year-over-year revenue increase in Q3, both Asia and EMEA were the only regions to exceed the average fee from Q3 2019 levels. The average fee for Asian equities rose by 19% from 93 bps two years prior, while equities in EMEA outperformed by a similar margin, 12%, over the same period to 90 bps. Although the Naspers “N” exchange offer played a significant role in the increase in EMEA, high–profile specials in Asia, like HMM Company (011200 KS) and China Evergrande Group (3333 HK) appear to continue driving lending revenue.

VOLUME WEIGHT AVERAGE FEE FOR EQUITIES

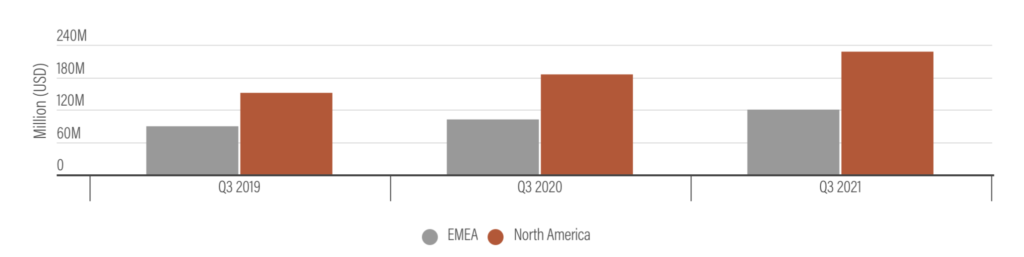

Sovereign Debt Update

Revenue generated by government debt has steadily risen over the past year, with the U.S. Treasury 10-year note being a top–three earner in March and German bunds exceeding 60% utilization over the past three months. In Q3 2021, the revenue trend continued as EMEA and North American debt have increased by 18% and 23% respectively over 2020 and a massive 35% and 51% over the same period in 2019.

SOVEREIGN DEBT REVENUE

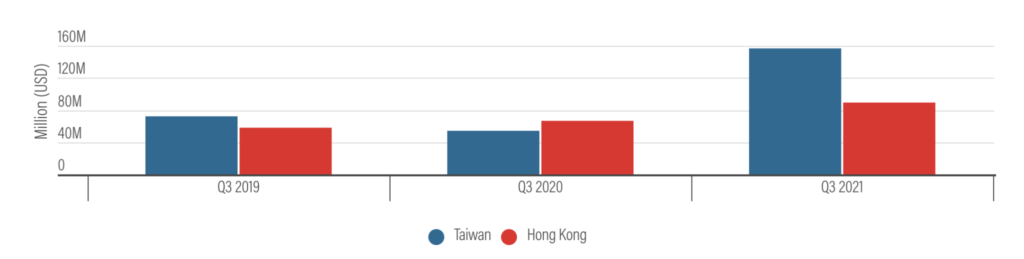

Non-GC Revenue Rising in Taiwan and Hong Kong

Equities from Taiwan and Hong Kong trading at fees above 25 bps have experienced a significant growth in revenue in Q3. Compared to the same period in 2020, revenue has risen by 189% and 34% for Taiwan and Hong Kong, respectively. Similar increases were observed when comparing to the same period in 2019, with a 117% increase for Taiwan and a 54% increase for Hong Kong.

NON-GC REVENUE

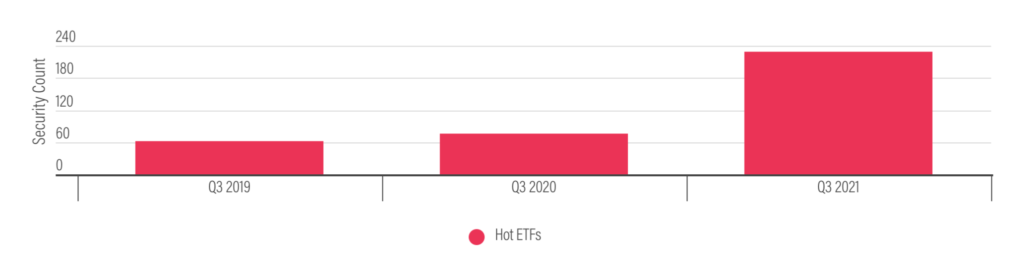

Hot ETFs in the US

2021 has been a banner year for ETF activity with high-yield corporate bond ETF HYG frequently appearing in our monthly revenue recaps. Within the U.S., many more ETFs traded at fees above 1,000 bps in Q3—229 in total—compared to just 76 and 62 in Q3 2020 and 2019, respectively. While the overall count of ETFs has risen as well, the percentage of those over 1,000 bps fee represents 11% of all U.S. ETFs on loan compared with just 3% in 2019 and 4% in 2020.

HOT US ETFs