Insight

Nov 2025

Nick Delikaris

EquiLend Client Forum:

5 Roadmap Takeaways You Need To Know

Our recent Client Forum Series was an exciting first for EquiLend as we move into a new phase with new leadership, renewed energy and a rededication to the client focus that makes EquiLend the firm it is today. Here’s the key takeaways from the forum from our Chief Product Officer, Nick Deliakris.

We’re Listening – Your Feedback is Shaping our Roadmap

Since the beginning of the year, the product team has engaged with more than 500 clients worldwide to understand priorities and emerging industry themes. This feedback has directly informed our new roadmap with collaboration and client engagement at the core of our strategy.

Recent client polling at the forum also provided valuable insight into market sentiment heading into 2026. Over 65% of respondents expect technology spend to rise by up to 15%, highlighting a continued focus on automation, smarter data and operational resilience.

What Underpins the Roadmap – Our 4 Pillars of Focus

The product vision is organized around four themes:

- Modernization & Innovation: upgrading core products with new enhancements, UI frameworks and usability improvements.

- Integration & Connectivity: driving greater interoperability across the securities finance ecosystem and ensure seamless integration within EquiLend’s product suite.

- New Products: launching offerings like Basket Maintenance and 1Source to automate complex workflows.

- Market Expansion: broadening our product footprint across the Middle East, Canada, and APAC, while addressing evolving global regulatory standards.

When asked which developments would most impact the industry in 2026, clients ranked Regulation and RegTech highest, followed by Collateral Optimization and Central Clearing, clear indicators that automation and compliance remain central industry priorities.

Data integration and AI adoption also continue to gain momentum. Over one-third of firms now use intraday securities lending data in their workflows and 43% report using AI daily, reflecting growing reliance on real-time intelligence in decision-making.

These findings reinforce EquiLend’s roadmap focus on technology, data and automation to ensure our solutions align with the industry appetite for progress.

We’re Investing Heavily in Our Core Products

While new solutions are exciting, our core products remain a priority. We continue to invest in refreshed designs, increased NGT abilities, enhanced analytics dashboards, simplified onboarding and expanded SFTR features — including our continued support of third-party file formats for greater interoperability and resilience.

We Are Prepared for New and Ongoing Regulatory Change

As settlement cycles shorten, the most effective path forward for securities finance is greater automation. From recalls and returns to SSIs, automation will be critical to meeting tighter timelines. We remain committed to leading the industry in supporting clients across the evolving regulatory landscape. From T+1 to SFTR to 10c-1a, we’re working side by side with clients to ensure they’re prepared.

The Next Frontier for EquiLend - OneSource, Data, and Clearing

Our next big launch is 1Source, our DLT solution delivering a single source of truth for the trade lifecycle. The 1Source go live in October 2026 with North American partners is the beginning of a new wave of transformational change for the industry is and set to expand globally shortly after. Further data innovation is another frontier with our plans for forecasted short interest models and the continued development of EquiLend AI Assistant. Meanwhile, integration with Cboe Clear Europe and a standardized clearing model will help clients tackle capital and RWA pressures.

Reach out to us for more information on any of these developments via our contact us page: https://equilend.com/contact-us/.

You may also like:

A Review of the Canadian Securities Finance Market in 2025

A review of the Canadian securities finance market for the full year...

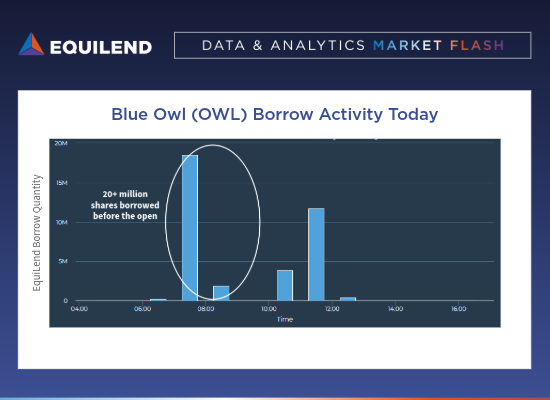

Read MoreMarket Flash on Blue Owl (OWL)

EquiLend Real Time Data shows short demand surged in OWL after withdrawal...

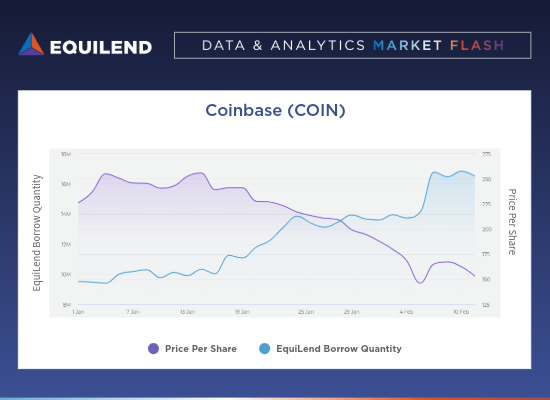

Read MoreMarket Flash on Crypto Winter

EquiLend data shows short demand rising in COIN and DFDV even as...

Read More