Insight

Feb 13, 2026

Market Flash

Market Flash on Crypto Winter

Short Interest Surges Amid Fears of Another Crypto Winter

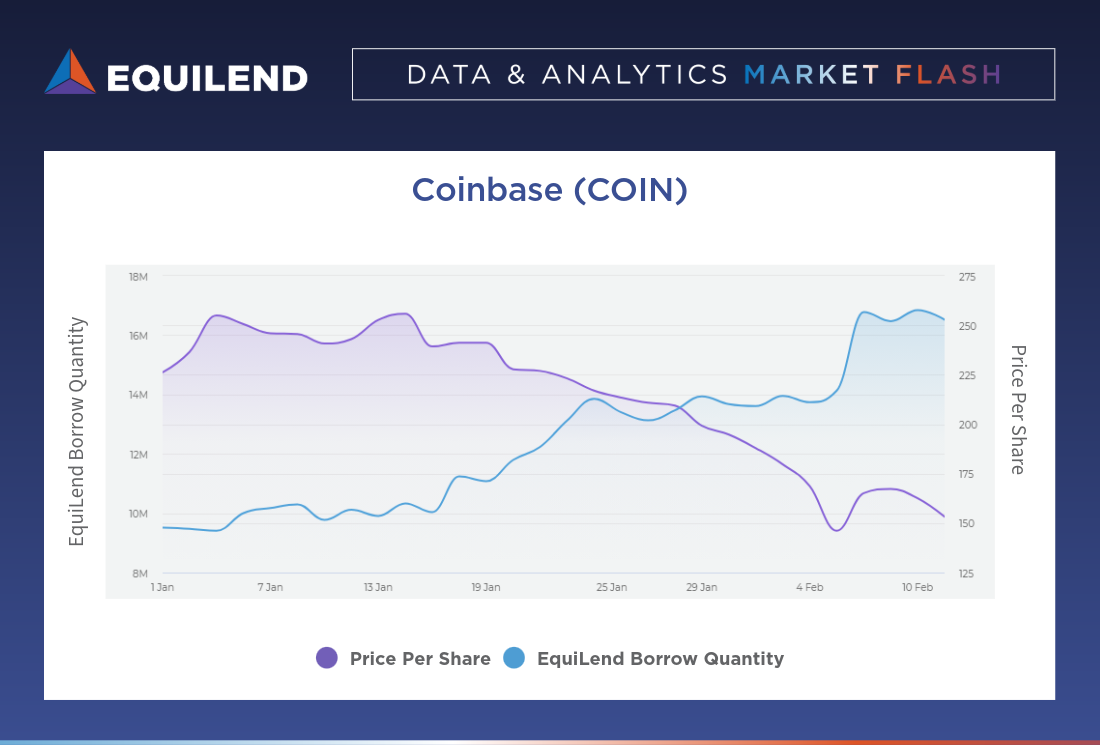

Bearish sentiment toward crypto has accelerated in early 2026, marked by a sharp divergence between falling token prices and rising securities‑lending activity in crypto‑exposed stocks – particularly Coinbase (COIN) and DeFi Development (DFDV).

EquiLend Borrow Quantity, a leading indicator of short‑selling demand, has increased sharply in both names since the start of the year. For Coinbase, borrow levels rose from 9.5 million shares to 16.8 million by February 10th (+76.8%). Those short sellers have benefited from this positioning, with COIN shares down 40% year to date, including an additional 8% intraday decline on February 12th ahead of Q4 earnings.

DeFi Development saw an even steeper increase, with borrow levels rising from 2.0 million shares late last year to 6.65 million by February 3rd (+233%), while EquiLend utilization reached 97%. That positioning has coincided with a 26% year‑to‑date decline in the stock.

Despite efforts by both companies to steady sentiment with positive corporate updates, the broader backdrop of declining crypto prices – including weakness in major tokens such as Bitcoin – has fueled skepticism about the sector’s resilience.

Persistent increases in EquiLend Borrow Quantity suggests that short sellers have not meaningfully covered. Instead, the data indicates investors are bracing for continued volatility and positioning for the possibility of a renewed “Crypto Winter”.

The EquiLend Edge

EquiLend’s short sale & financing data provides actionable intelligence on evolving market sentiment that traditional metrics may not capture.

Book a demo of EquiLend Data & Analytics today to receive these signals and more in real-time: https://equilend.com/contact-us/.

Bloomberg Terminal users can subscribe to EquiLend’s exclusive short selling and financing data by entering terminal shortcut APPS ORBISA <GO> or clicking the following link: https://on.equilend.com/bloomberg-terminal-page.