Insight

Oct 21, 2025

Market Flash

Market Flash on French Government Bond Turmoil

French Bond Yields Rise after S&P Downgrades Credit Rating

In an unforeseen move, S&P Global Ratings downgraded the French sovereign credit score from AA- to A+ amidst recent political turmoil in Paris. The move triggered a fall in the price of French bonds in Monday trading with yields rising in tandem, reflecting the increased risk felt by investors.

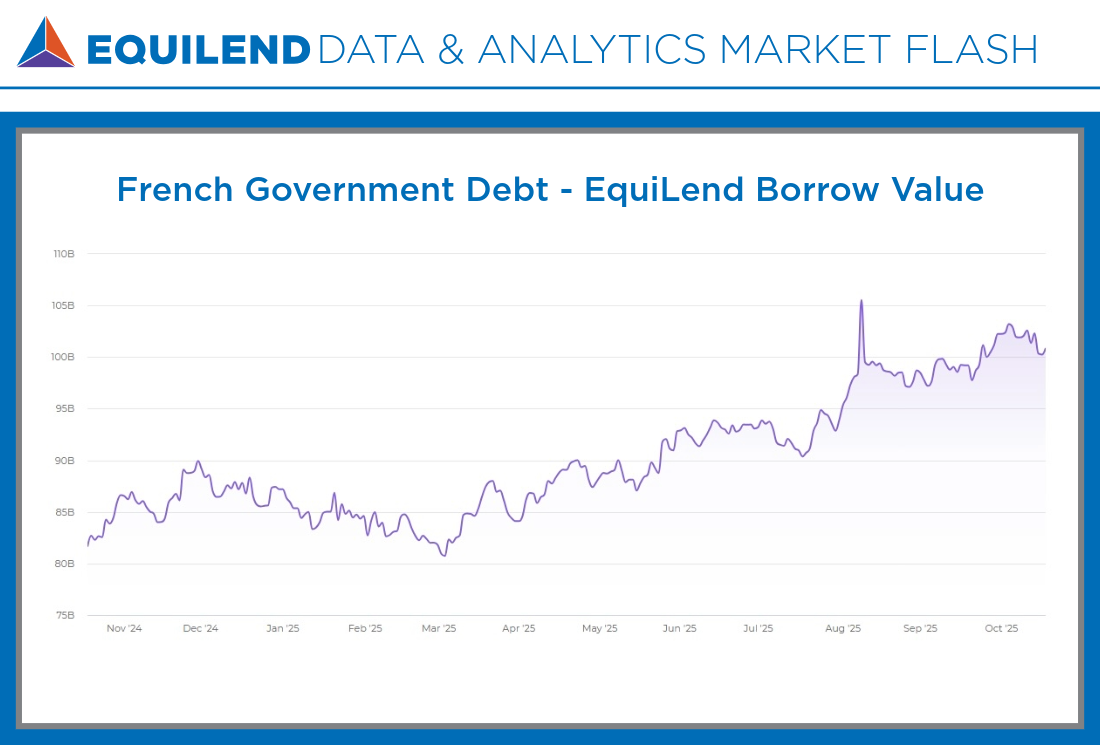

Leading up to this news, EquiLend Data & Analytics saw rising negative sentiment around the French Bond market as demand for these bonds continually increased since March of this year. The EquiLend Borrow Value across the sector rose significantly in the last year but notably jumped 11.6% in the last quarter alone, increasing from $90 billion to over $100 billion.

Demand for French Government Debt is not limited to one or two issuances either. The list below highlights the 10 ISINs with the biggest rise in EquiLend Borrow Quantity over the last month. Be sure to log in to EquiLend Data & Analytics today to get the full list leveraging the new Screener functionality!

ISIN | Bond | EquiLend Borrow Quantity | MoM Difference | MoM (%) Difference |

FR001400PM68 | FRTR 3 ½ 11/25/35 | 4,577,865,080 | 1,346,403,000 | 42% |

FR0000571218 | FRTR 5 ½ 04/25/29 | 9,348,774,470 | 1,028,608,000 | 12% |

FR001400XLW2 | FRTR 2.4 09/24/28 | 1,532,520,000 | 648,722,000 | 73% |

FR001400AQH0 | FRTR 0.1 07/25/38 | 635,010,902 | 249,107,500 | 65% |

FR0010371401 | FRTR 4 10/25/38 | 1,278,659,251 | 227,469,999 | 22% |

FR0011461037 | FRTR 3 ¼ 05/25/45 | 1,185,952,820 | 221,690,091 | 23% |

FR001400NBC6 | FRTR 2 ½ 09/24/27 | 1,784,110,999 | 199,179,000 | 13% |

FR0013154044 | FRTR 1 ¼ 05/25/36 | 1,970,777,999 | 198,905,000 | 11% |

FR0013234333 | FRTR 1 ¾ 06/25/39 | 1,400,346,907 | 188,673,186 | 16% |

FR001400AIN5 | FRTR 0 ¾ 02/25/28 | 1,976,783,079 | 171,861,000 | 10% |

The EquiLend Edge

EquiLend’s short sale & financing data provides actionable intelligence on evolving market sentiment that traditional metrics may not capture.

Book a demo of EquiLend Data & Analytics today to receive these signals and more in real-time: https://equilend.com/contact-us/.

Bloomberg Terminal users can subscribe to EquiLend’s exclusive short selling and financing data by entering terminal shortcut APPS ORBISA <GO> or clicking the following link: https://on.equilend.com/bloomberg-terminal-page.