Insight

April 30, 2025

Market Flash

Market Flash on Janover Inc (JNVR)

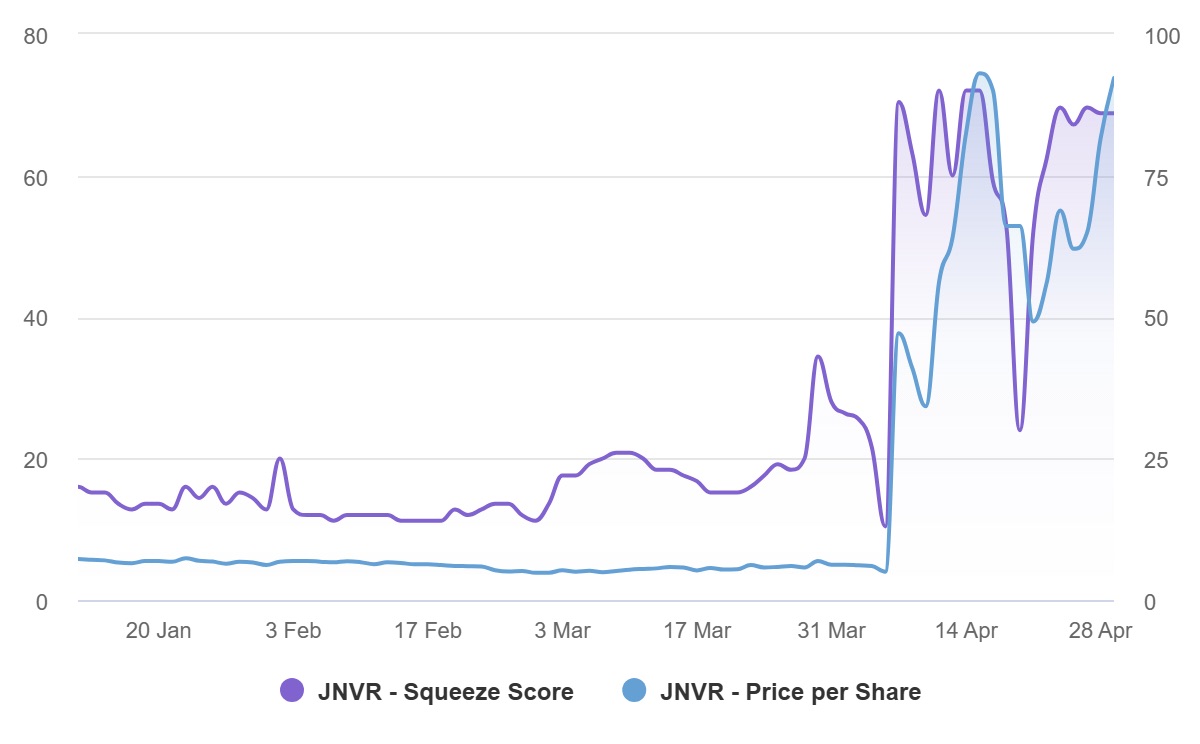

EquiLend Data & Analytics identifies Janover Inc as a prime short squeeze candidate, as the EquiLend Short Squeeze Score surged to 86 indicating extreme potential for continued short covering.

Company Overview

- Janover operates in the financial technology sector, providing digital solutions for commercial real estate financing

- The company’s recent strategic shift toward cryptocurrency investments represents a significant departure from its traditional business model

- This pivot comes amid growing institutional adoption of digital assets and blockchain technology in the financial services industry

Catalyst

- Janover Inc’s Board of Directors approved a new treasury policy on April 4, 2025, authorizing the long-term accumulation of crypto assets

- The company purchased $4.6 million in Solana cryptocurrency, signaling a strategic pivot toward digital asset investments

- The stock surged by an extraordinary 347% on April 7, 2025, followed by continued momentum with an additional 7.18% increase on April 11

Market Implications

- This event showcases the powerful impact of cryptocurrency adoption by publicly traded companies

- The combination of extremely high borrowing costs (30,000+ bps) and elevated utilization (77%) creates ideal conditions for a sustained squeeze

Squeeze Analysis

- Janover’s squeeze score of 86 represents an exceptional level among potential short squeeze candidates in our screening parameters

- The current borrowing fee of 30,000+ bps is exceptionally high, even compared to other squeeze candidates, indicating extreme pressure on short sellers

- With a market capitalization of approximately $105 million, the stock’s relatively small float makes it particularly susceptible to squeeze dynamics

Technical Analysis

- The stock has experienced explosive price action, breaking through multiple resistance levels on heavy volume

- The Squeeze Score has surged to 86 indicating extreme potential for continued short covering

- The current score represents a dramatic 43-point increase from the previous month, highlighting the rapidly intensifying squeeze conditions

Conclusion

Janover Inc presents an extraordinary case study in short squeeze dynamics. The combination of a very high Short Squeeze Score in our universe (86), astronomical borrowing costs (30,000+ bps) and a clear catalyst in the form of cryptocurrency adoption has created conditions for potentially historic price volatility. Market participants should monitor this situation closely while maintaining strict risk management protocols given the extreme nature of the current setup.

Contact us at https://equilend.com/services/equilend-short-squeeze-score/ to find out how you can leverage EquiLend’s Short Squeeze Score today.

Bloomberg Terminal users can subscribe to EquiLend’s exclusive Orbisa securities lending data by entering terminal shortcut APPS ORBISA <GO> or clicking the following link: https://on.equilend.com/bloomberg-terminal-page