Insight

JULY 25, 2025

Market Flash

Market Flash on Kohl's (KSS) and Opendoor (OPEN)

The Return of Meme Stock Mania

Recent market activity has shown how heavily shorted stocks can be affected by coordinated retail trading campaigns. Our analysis of Kohl’s Corporation (KSS) and Opendoor Technologies (OPEN) identifies patterns in securities finance metrics that indicate elevated short squeeze risk as meme stock mania returns.

Market Context

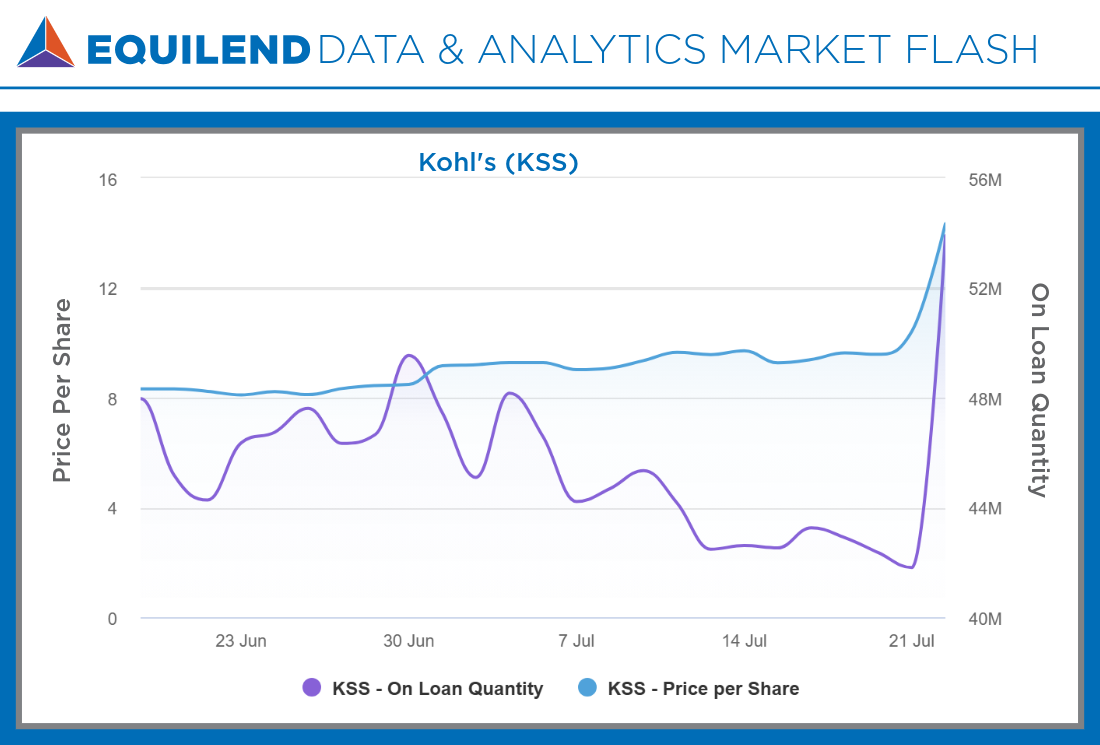

Both KSS and OPEN have experienced significant volatility amid high short interest levels. Kohl’s (KSS) recently saw a significant intraday rally, with shares increasing more than 105%, which triggered multiple trading halts. When trading resumed, the stock was up more than 35% and finished the day at $14.34. The rally was not driven by fundamental company news but was attributed by news outlets to a “meme stock” rally, where retail traders targeted the stock due to its large outstanding short interest. Already a heavily shorted stock, investors appear to be betting against the meme rally as our data shows that borrow quantity, a gauge of short interest, increased by 29% on Tuesday, rising from 42 million to 54 million shares.

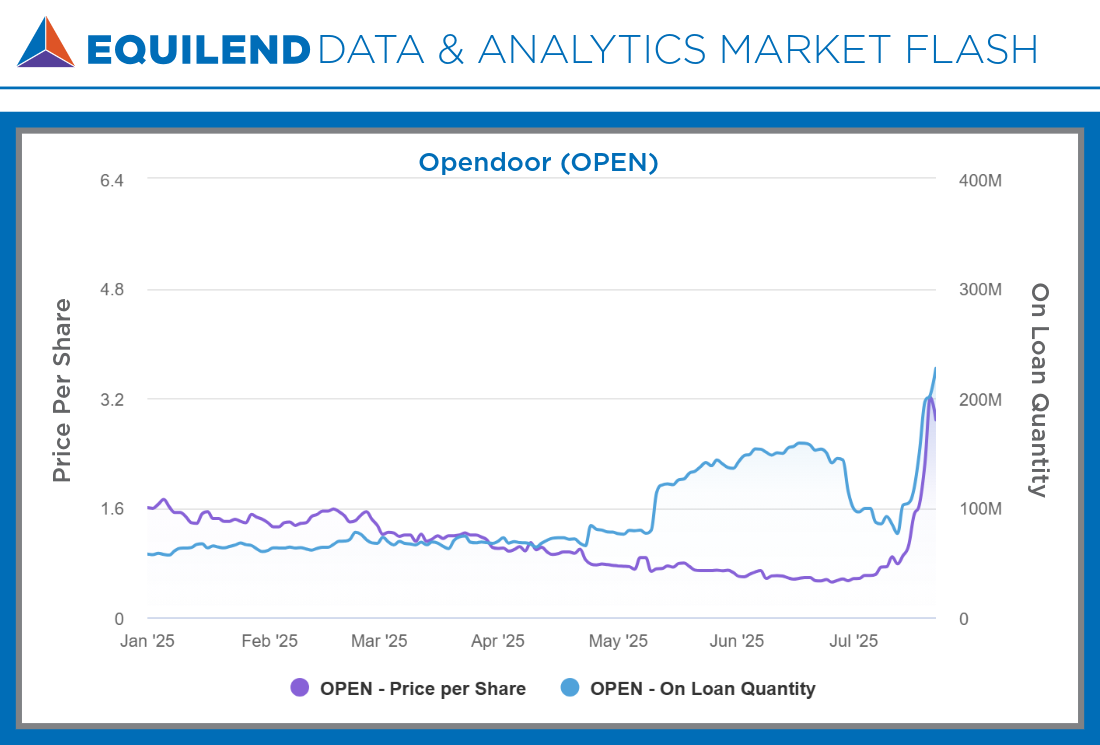

Meanwhile, Opendoor (OPEN) ended the trading day more than 10% lower after rising more than 90% over the previous 2 days. The dramatic price increase prior to the drop was not based on company fundamentals and largely fueled by a recommendation from hedge fund manager Eric Jackson of EMJ Capital, who called the stock a potential “100 bagger,” igniting discussions on social media platforms like Reddit and X. During yesterday’s sell-off, the stock saw its borrow quantity spike 22% during the day and its utilization rate surged up to 94%. Borrowing costs, as well, surged up to more than 1630 bps, suggesting continued pressure on its short positions.

Conclusion

Renewed interest in “meme stocks” has spurred increased activity in specific securities as of late. The concentration of short interest in both KSS and OPEN creates conditions where coordinated buying activity could result in significant price appreciation, otherwise known as a short squeeze. Our data reflects this trend, showing heightened borrowing activity and elevated risk profiles for both securities. This is reflected in EquiLend’s Short Squeeze Scores, which peaked at 86 for OPEN prior to yesterday’s sell-off and sits at 64 for KSS after yesterday’s rally. These scores highlight the growing risk to short sellers in this current market environment. Be sure to subscribe to EquiLend Data & Analytics as this phenomenon may be broadening, as our data also shows increased borrowing demand in other heavily shorted names attracting social media interest, including Krispy Kreme (DNUT), GoPro (GPRO), and American Eagle Outfitters (AEO).

Book a demo of EquiLend Data & Analytics today to receive these signals and more in real-time: https://equilend.com/contact-us/.

Bloomberg Terminal users can subscribe to EquiLend’s exclusive short selling and financing data by entering terminal shortcut APPS ORBISA <GO> or clicking the following link: https://on.equilend.com/bloomberg-terminal-page.