Insight

July 21, 2025

Market Flash

Market Flash on Lucid Motors (LCID)

Skepticism Greets Lucid-Uber Robotaxi Deal as Short Interest Remains Elevated

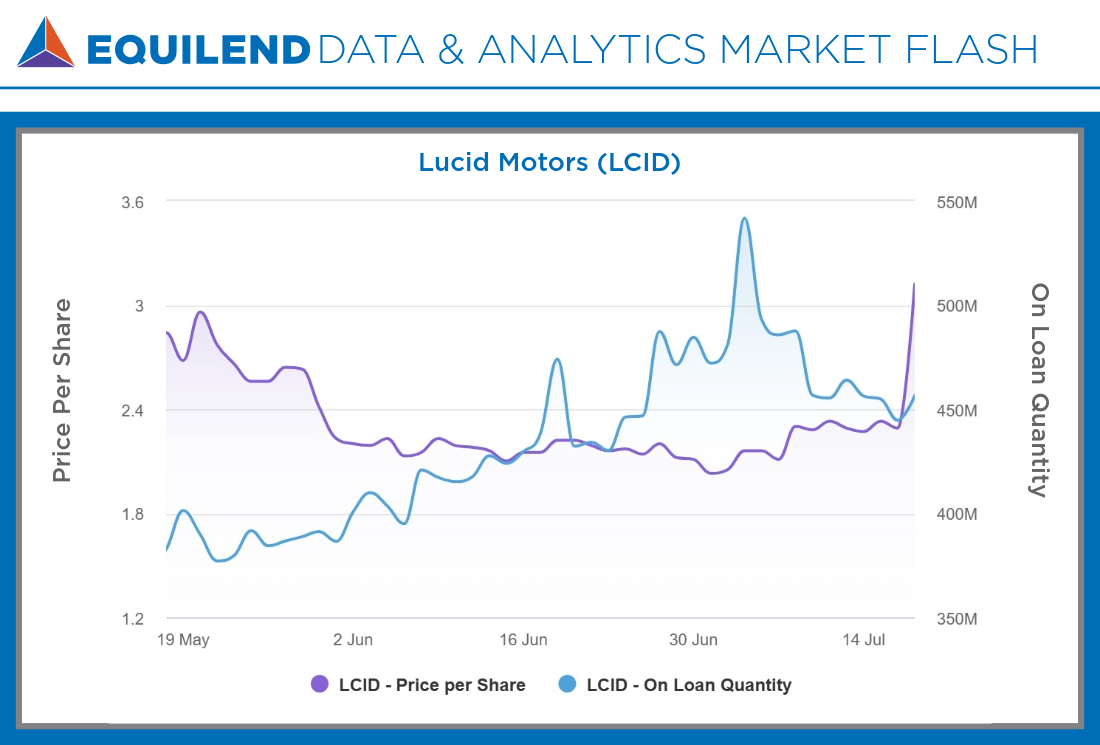

In our latest EquiLend Data & Analytics Market Flash, we analyze market sentiment surrounding Lucid Motors (LCID) in real-time following today’s announcement of a major robotaxi partnership with Uber and Nuro.

Market Context

Uber announced Thursday its plan to deploy over 20,000 Lucid vehicles equipped with Nuro’s autonomous driving technology over the next six years, with a planned launch in 2026. Shares of Lucid’s stock jumped nearly 40% as of Thursday, while Uber traded roughly flat. Our real-time data showed that short-sellers may have been doubling down throughout the day during the price surge. Over 15.4 million net new shares were borrowed intraday Thursday, nearly 8x the daily average for the last month, financed at a rate near 880 bps.

While a deal of this scale would typically be a major catalyst, the announcement was met with immediate caution from Wall Street. Analysts noted that Lucid, which delivered 10,000 cars in 2024 with a target of 20,000 in 2025, may struggle to meet Uber’s demand without substantial new capital.

EquiLend Data & Analytics Insights

Wall Street’s skepticism regarding Lucid’s ability to execute aligns with the bearish sentiment observed in EquiLend’s securities finance data leading up to the announcement.

- Pre-Existing Bearish Stance: The skepticism seen Thursday was not new. As of Wednesday’s close, the number of LCID shares on loan was already 444 million, 47% higher than one year ago, potentially indicating that some bearish positioning has been building over the past 12 months.

- Intense and Sustained Borrow Demand: Utilization has remained above 90% for all but one day since the beginning of June. This level shows that the supply of lendable shares was already exhausted before Thursday’s news.

Analysis

Thursday’s news brings into sharp focus the narrative that our data has been signaling for months. The EquiLend data suggests that institutional players were not positioned for a positive surprise. Instead, the high level of borrowing activity may have been a pre-emptive sign of the market’s skepticism about Lucid’s ability to deliver on large-scale commitments. The data provides a critical layer of context for investors around market sentiment and positioning.

Book a demo of EquiLend Data & Analytics today to receive these signals and more in real-time: https://equilend.com/contact-us/.

Bloomberg Terminal users can subscribe to EquiLend’s exclusive short selling and financing data by entering terminal shortcut APPS ORBISA <GO> or clicking the following link: https://on.equilend.com/bloomberg-terminal-page.