Insight

May 8, 2025

Market Flash

Market Flash on NetClass Technology (NTCL)

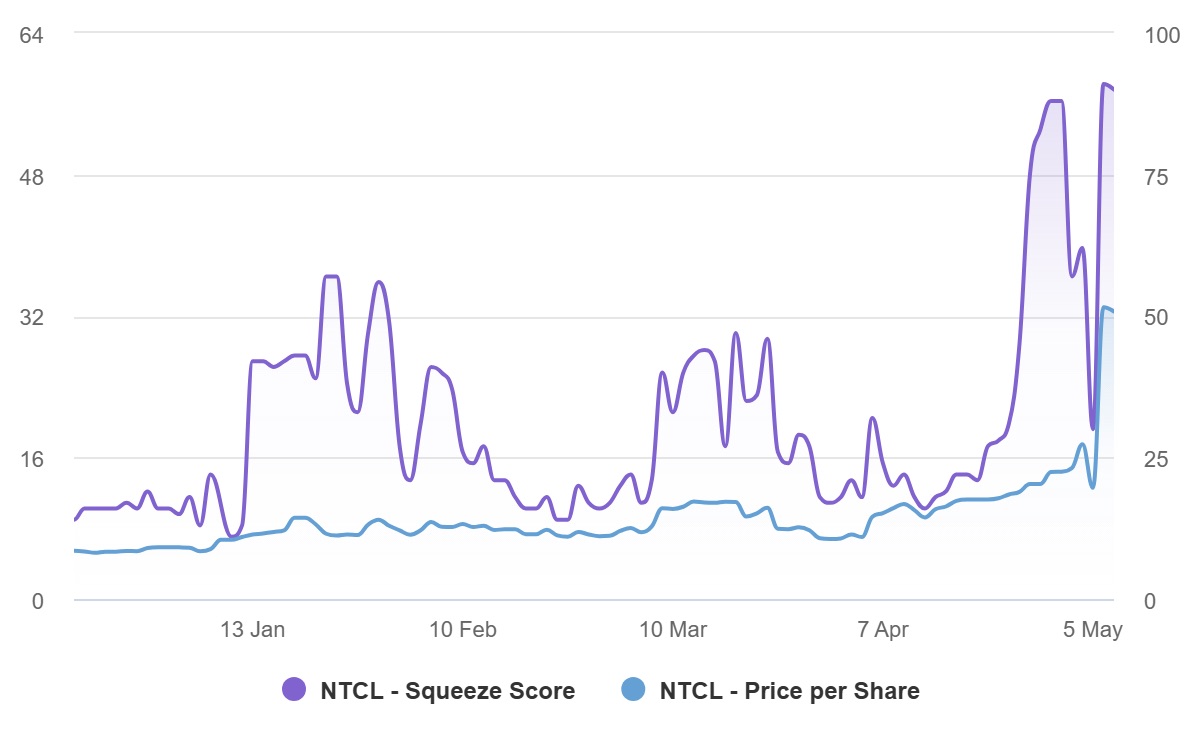

EquiLend Data & Analytics identifies NetClass Technology as a prime short squeeze candidate, with its short squeeze score at 90. With utilization at nearly 100% and extremely elevated borrow fees of 12,600 BPS, short sellers are facing mounting pressure. This consumer discretionary company has seen its short squeeze score surge from 24 to 90 in just one month, potentially triggering a significant short covering rally in the coming days.

Company Overview

NetClass Technology Inc. operates in the consumer services segment of the consumer discretionary sector. The company provides digital education technology solutions, focusing on interactive learning platforms and virtual classroom environments. As the education technology space continues to evolve post-pandemic, NetClass has positioned itself at the intersection of consumer services and educational technology.

Note: Data as of May 8, 2025. EquiLend Short Squeeze Score ranges from 0-100, with higher scores indicating greater likelihood of a short squeeze.

Catalyst

NetClass Technology has recently announced significant expansion of its platform capabilities, including enhanced AI-driven personalization features and strategic partnerships with major educational institutions. These developments have positioned the company to capture increased market share in the competitive edtech space. This positive momentum has attracted investor interest while simultaneously putting pressure on the substantial short positions in the stock.

Market Implications

The education technology market continues to evolve rapidly, with increasing demand for personalized, interactive learning solutions. NetClass’s recent innovations address key pain points in virtual education delivery, potentially disrupting traditional educational service providers. The company’s focus on consumer-friendly interfaces combined with institutional-grade content delivery systems creates a compelling value proposition. However, the dramatic price increase following recent announcements has attracted significant short interest, setting up conditions for a potential short squeeze.

Squeeze Analysis

NetClass Technology (NTCL) currently has a short squeeze score of 90. Our proprietary EquiLend Short Squeeze Score metric, which ranges from 0 to 100, measures the likelihood of a potential short squeeze by analyzing factors such as short interest, borrowing costs and price momentum. The score has seen a dramatic increase from 24 just one month ago to 90 today, indicating rapidly growing pressure on short sellers.

The stock’s utilization rate of nearly 100% has reached critical levels, suggesting that available shares for borrowing are essentially exhausted. The high utilization is accompanied by an elevated borrowing fee of 12,600 BPS (126% annualized). These securities lending metrics indicate supply constraints and prohibitive costs for maintaining short positions.

The combination of positive business developments, strong quarterly results and deteriorating securities lending metrics creates ideal conditions for a potential short squeeze. As the stock price continues to rise, short sellers may be forced to cover their positions, further accelerating the upward price movement in a self-reinforcing cycle.

Technical Analysis

NetClass Technology’s stock has established a strong uptrend, breaking above key resistance levels with increasing volume. The price action shows momentum building as the stock makes new highs, with technical indicators suggesting continued strength. Overall, the technical picture remains bullish, supported by both fundamental catalysts and the extreme securities lending metrics.

Conclusion

NetClass Technology (NTCL) presents a compelling short squeeze possibility due to its short squeeze score of 90, elevated borrowing fee of 12,600 BPS, nearly full utilization rate of 100% and recent positive business developments serving as catalysts.

The combination of fundamental improvements, technical breakout and deteriorating securities lending metrics suggests that short sellers are under significant pressure. The dramatic increase in short squeeze score from 24 to 90 in just one month indicates rapidly accelerating pressure that could trigger a substantial short covering rally.

Traders should monitor NTCL closely, particularly for increases in trading volume and acceleration in price movement, which could signal the beginning of a more pronounced squeeze. However, given the stock’s recent volatility and momentum, position sizing and risk management remain crucial considerations.

Contact us at https://equilend.com/services/equilend-short-squeeze-score/ to find out how you can leverage EquiLend’s Short Squeeze Score today.

Bloomberg Terminal users can subscribe to EquiLend’s exclusive Orbisa securities lending data by entering terminal shortcut APPS ORBISA <GO> or clicking the following link: https://on.equilend.com/bloomberg-terminal-page