Insight

September 24, 2025

Market Flash

Market Flash Opendoor Technologies (OPEN)

Opendoor and its Open Army: From Delisting Risk to a 1700% Rally

Market Context

A 2020 IPO via SPAC focused on purchasing US-based real estate directly from homeowners, Opendoor Technologies (OPEN US), checked all the short-selling buzzwords over the past two months as retail investors boosted shares by over 1700%.

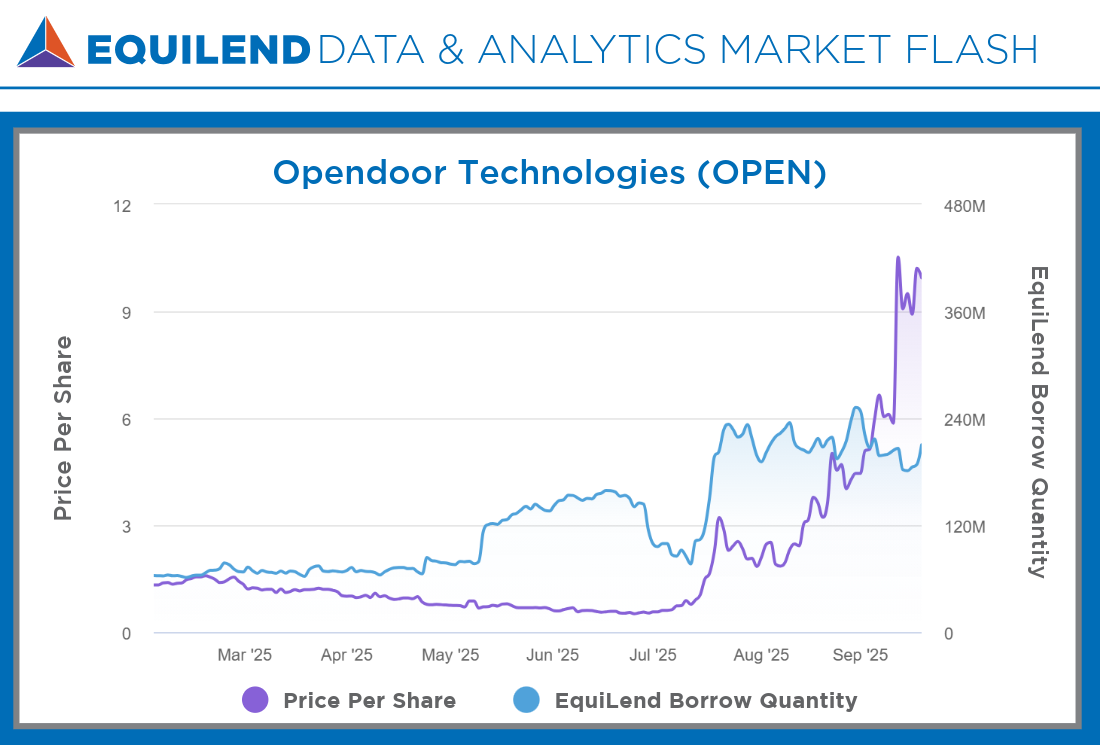

The technology firm has been under scrutiny by retail investors and its original founders after a dovish Q3 outlook became the catalyst for a change in management. With support from its retail investors (“Open Army”), Opendoor replaced its CEO, provided board positions for the company’s founders and made plans to incorporate AI within its buying tools. The result was a drastic increase in share price, exceeding $10 in mid-September, compared to $0.57 at the beginning of July, Nasdaq’s delisting level.

Within the securities lending market, EquiLend Utilization rates rose to 100% once the pricing volatility began in mid-July. EquiLend Borrow Quantity decreased from 217 million shares at the end of July to 181 million shares in mid-September, suggesting short positions are quickly covering to avoid any additional meme-inspired rallies. Currently at 5%, EquiLend’s Cost to Borrow has been trending downward, which is uncharacteristic for a security in high demand; however, the cost to borrow can easily reverse course if share availability remains limited. EquiLend’s Real Time Data With the “Open Army” watching closely, it will be fascinating to see how short sellers have adapted to meme stocks since 2021.

The EquiLend Edge

The combination of strong price performance with expanding short interest creates a dynamic worth monitoring. EquiLend’s short sale & financing data provides actionable intelligence on evolving market sentiment that traditional metrics may not capture.

Book a demo of EquiLend Data & Analytics today to receive these signals and more in real-time: https://equilend.com/contact-us/.

Bloomberg Terminal users can subscribe to EquiLend’s exclusive short selling and financing data by entering terminal shortcut APPS ORBISA <GO> or clicking the following link: https://on.equilend.com/bloomberg-terminal-page.