Insight

Nov 21, 2025

Market Flash

Market Flash on Blue Owl Capital (OWL US)

As Borrow Demand Climbs, Blue Owl Finds Itself in a Not-So-Wise Spot

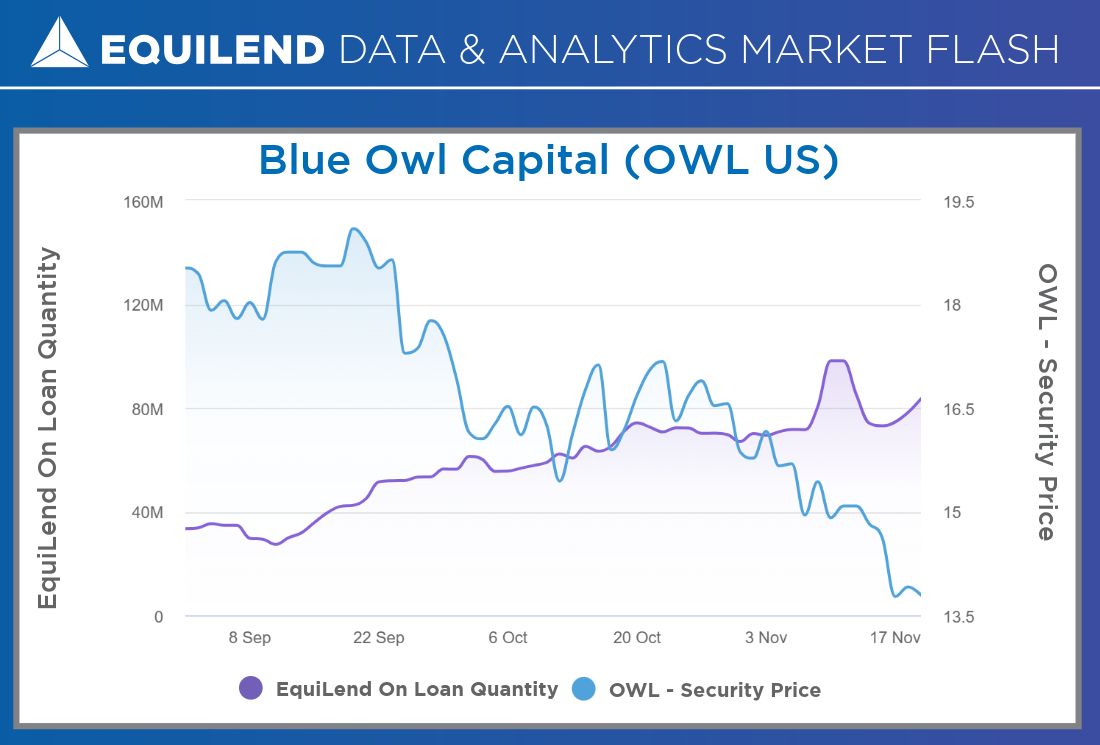

Borrow demand in Blue Owl Capital’s listed vehicles (OWL US and OBDC US) has surged in recent months, indicating an early signal of concerns around the private credit market. EquiLend’s Borrow Quantity, a leading indicator of short interest, for OWL US has jumped 150% since September, rising from 33.4 million to 83.5 million shares, while OBDC US has climbed to 16.4 million shares from 10.2 million over the same period. EquiLend’s real-time securities lending data suggests investors are positioning for further declines in OWL US beyond its 25% slide since September.

The rise in borrow demand has coincided with growing scrutiny of the private credit market following two high-profile failures, auto-parts manufacturer First Brands and subprime auto lender Tricolor, which prompted JPMorgan CEO Jamie Dimon to warn that deeper problems may exist in the opaque market. The pressure continued as Blue Owl planned a merger between its private OBDC II vehicle and its publicly traded OBDC fund (OBDC US), after investors pushed back against a deal that would have forced a 20% NAV loss by circumventing their quarterly redemption process.

Although Blue Owl’s board ultimately halted the merger, borrow demand in both OWL US and OBDC US has continued to climb, highlighting a growing focus on liquidity and valuation risks across private credit.

The EquiLend Edge

EquiLend’s short sale & financing data provides actionable intelligence on evolving market sentiment that traditional metrics may not capture.

Book a demo of EquiLend Data & Analytics today to receive these signals and more in real-time: https://equilend.com/contact-us/.

Bloomberg Terminal users can subscribe to EquiLend’s exclusive short selling and financing data by entering terminal shortcut APPS ORBISA <GO> or clicking the following link: https://on.equilend.com/bloomberg-terminal-page.