Insight

August 14, 2025

Market Flash

Market Flash on Paramount Global (PARA)

Borrow Activity Hits Climax as Skydance Merger Completes

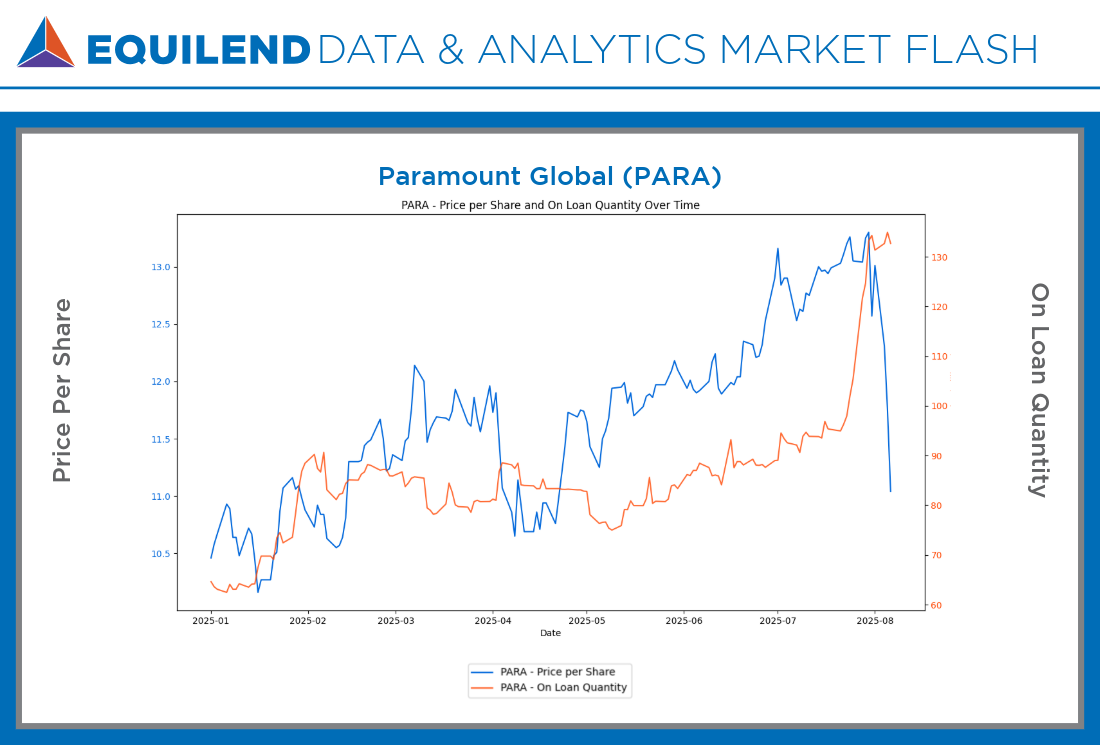

In this EquiLend Data & Analytics Market Flash, we provide a concluding analysis of the significant build-up of short interest in Paramount Global (PARA). As the company’s complex acquisition by Skydance Media officially closed, our data captured the intense, final wave of institutional activity. The data illustrates how conviction among traders, driven by both skepticism and sophisticated arbitrage strategies, crested in the final days leading up to the merger.

Market Context

Paramount Global was the subject of intense merger and acquisition speculation throughout 2025, culminating in a definitive merger agreement with Skydance Media. The $8.4 billion deal, which received FCC regulatory approval in late July, has officially closed. The new combined entity, Paramount Skydance Corporation (PSKY), began trading on August 7, following the final trading day for Paramount’s legacy stocks (PARA, PARAA) on August 6.

A critical component of this transaction was the tender offer made to Paramount’s public shareholders. The deal’s structure created a significant merger arbitrage opportunity that was a primary driver of the activity observed in the securities lending market. As of early August, Paramount’s Class B stock had been trading at a notable discount to the $15.00 cash offer, creating a spread that institutional investors were actively positioned to capture.

EquiLend Data & Analytics Insights

EquiLend’s securities finance data reveals a sharp and sustained increase in borrowing activity that peaked dramatically in the final days before the merger’s close, illustrating a clear pattern of building conviction.

- Sustained Build-Up: From May 1 to August 1, 2025, the number of PARA shares on loan increased by over 50.5 million. This represents a 60.9% increase, bringing the total to 133.5 million shares on loan as the final month of trading began.

- Intense Borrow Demand: Utilization, a measure of the percentage of the lendable supply that is on loan, climbed steadily, reaching a peak of around 94% on August 6, indicating extreme scarcity of lendable shares.

- Borrow Costs Spike at Climax: The most striking indicator of market positioning was the cost to borrow PARA shares, which reached extreme levels as the final closing approached. The fee to borrow stock began to climb in late July and experienced a significant surge in the final week, ultimately peaking at an annualized rate of 65,000 basis points (bps) on Tuesday, August 5. The scale of this event was notable, as the borrowing activity in PARA was so significant that it drove the average fee across the entire global securities lending market up by 94% day-over-day on August 5.

Analysis

EquiLend data illustrates how the completed M&A process and specific terms of the tender offer created fertile ground for institutional trading activity. The progression of borrowing metrics provides a clear narrative of building conviction that culminated in a final, frantic rush for shares. The sustained increase in borrowing activity was likely an indication of several factors, including merger arbitrage, skepticism over deal completion and hedging by long-holders.

The final surge in borrowing costs to 65,000 bps likely represents the “last call” for arbitrageurs and other traders to establish their final positions before the stock ceased trading. With the merger now complete, these positions will have been unwound or converted into the new entity (PSKY), causing the exceptional demand and fees for PARA to evaporate. This event serves as a clear case study on how EquiLend’s data provides actionable insights into the mechanics and sentiment driving major corporate actions.

Book a demo of EquiLend Data & Analytics today to receive these signals and more in real-time: https://equilend.com/contact-us/.

Bloomberg Terminal users can subscribe to EquiLend’s exclusive short selling and financing data by entering terminal shortcut APPS ORBISA <GO> or clicking the following link: https://on.equilend.com/bloomberg-terminal-page.