Insight

June 6, 2025

Market Flash

Market Flash on Simcere Pharmaceutical Group (2096 HK)

Short Positioning Rises Sharply as Stock Rallies 30% in 3 Weeks

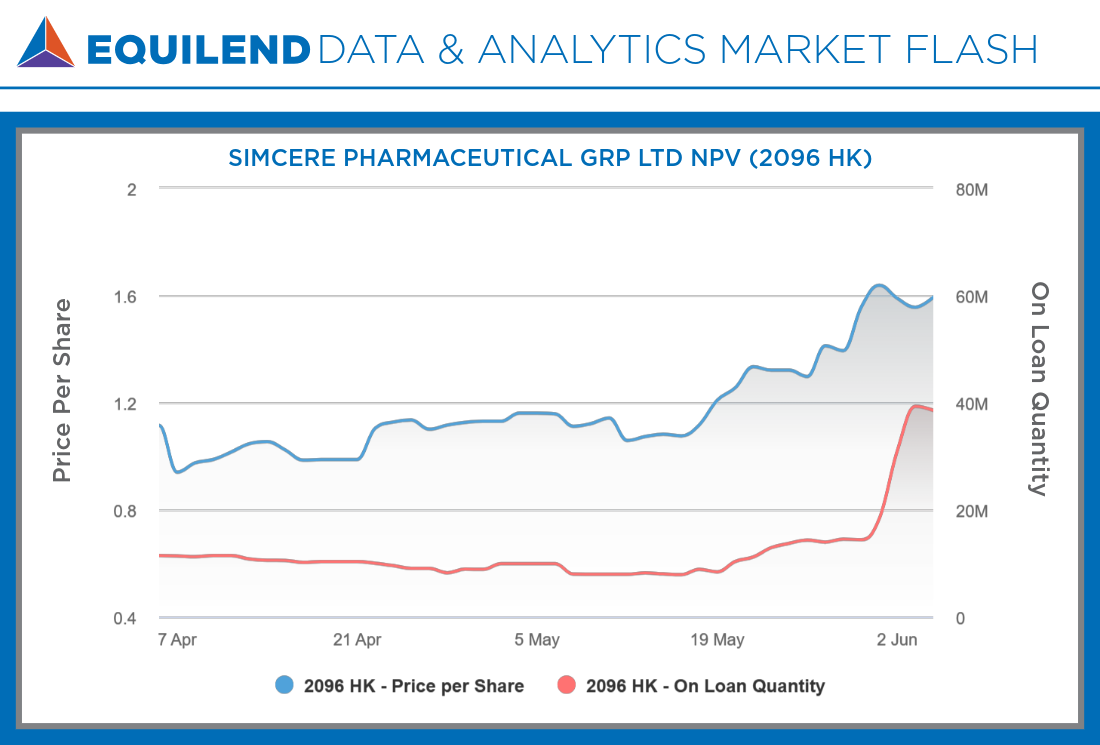

In our latest EquiLend Data & Analytics Market Flash, we identify a notable rise in short sale and financing activity for SIMCERE PHARMACEUTICAL GRP LTD NPV (2096 HK) that may reveal underlying market sentiment during significant price movements.

Market Context

Simcere’s 30% rally over three weeks reflects broader strength in Hong Kong’s pharmaceutical sector, where the Hang Seng Innovative Drug Index rose nearly 15% during that time. In April, the company obtained a Clinical Trial Approval issued by China’s National Medical Products Administration (NMPA) for its drug used for the treatment of gastric and lung cancer. China’s healthcare policy reforms—including fast-tracked drug approvals and expanded funding sources—have created a favorable operating environment.

Amidst the positive fundamental backdrop and price performance, EquiLend’s short sale & financing data reveals a growing number of short positions. The simultaneous rise in both share price and short interest could be an indication that market sentiment is shifting. This pattern suggests investors may be establishing or expanding short positions despite the recent rally. Such positioning could reflect expectations of a price correction from current levels.

Key Signals in Simcere's Equity

- Borrow quantity increased 182% week-over-week, rising from 14 million to 39.3 million shares, indicating a potential growing short sentiment

- The acceleration in short positioning occurred alongside a 30% price increase over the past 3 weeks, which may indicate the market does not believe the price increase is sustainable

- Utilization jumped from 19.72% to 52.10%, reflecting heightened demand for borrowing shares

- Days to cover stands at 2.55 days, suggesting moderate to normal liquidity for borrowers adjusting positions

The EquiLend Edge

The combination of strong price performance with expanding short interest creates a dynamic worth monitoring. EquiLend’s short sale & financing data provides actionable intelligence on evolving market sentiment that traditional metrics may not capture.

Book a demo of EquiLend Data & Analytics today to receive these signals and more in real-time: https://equilend.com/contact-us/.

Bloomberg Terminal users can subscribe to EquiLend’s exclusive short selling and financing data by entering terminal shortcut APPS ORBISA <GO> or clicking the following link: https://on.equilend.com/bloomberg-terminal-page.