Insight

April 28, 2025

Market Flash

Market Flash on Summit Therapeutics (SMMT)

EquiLend Data & Analytics identifies Summit Therapeutics as a prime short squeeze candidate, with its short squeeze score surging 43.0 points to 66 in just one month. With utilization approaching 78.98% and elevated borrow fees, short sellers are facing mounting pressure as positive clinical trial results drive momentum. This $24.5B biotech powerhouse has broken key technical resistance levels, potentially triggering a significant short covering rally in the coming weeks.

Company Overview

Summit Therapeutics Inc. is a biopharmaceutical company focused on the discovery, development and commercialization of novel antibiotics for the treatment of infectious diseases. The company’s lead product candidate is ridinilazole, which is being developed for the treatment of Clostridioides difficile infection (CDI). Summit is also developing a pipeline of novel mechanism antibiotics for the treatment of serious bacterial infections.

Catalyst

Summit Therapeutics recently announced positive results from its Phase 3 clinical trial for ivonescimab, a novel PD-1/VEGF bispecific antibody for the treatment of non-small cell lung cancer (NSCLC). The trial demonstrated a statistically significant improvement in progression-free survival compared to standard of care. This breakthrough has significantly increased investor interest in the company, potentially triggering a short squeeze as short sellers reassess their positions.

Squeeze Analysis

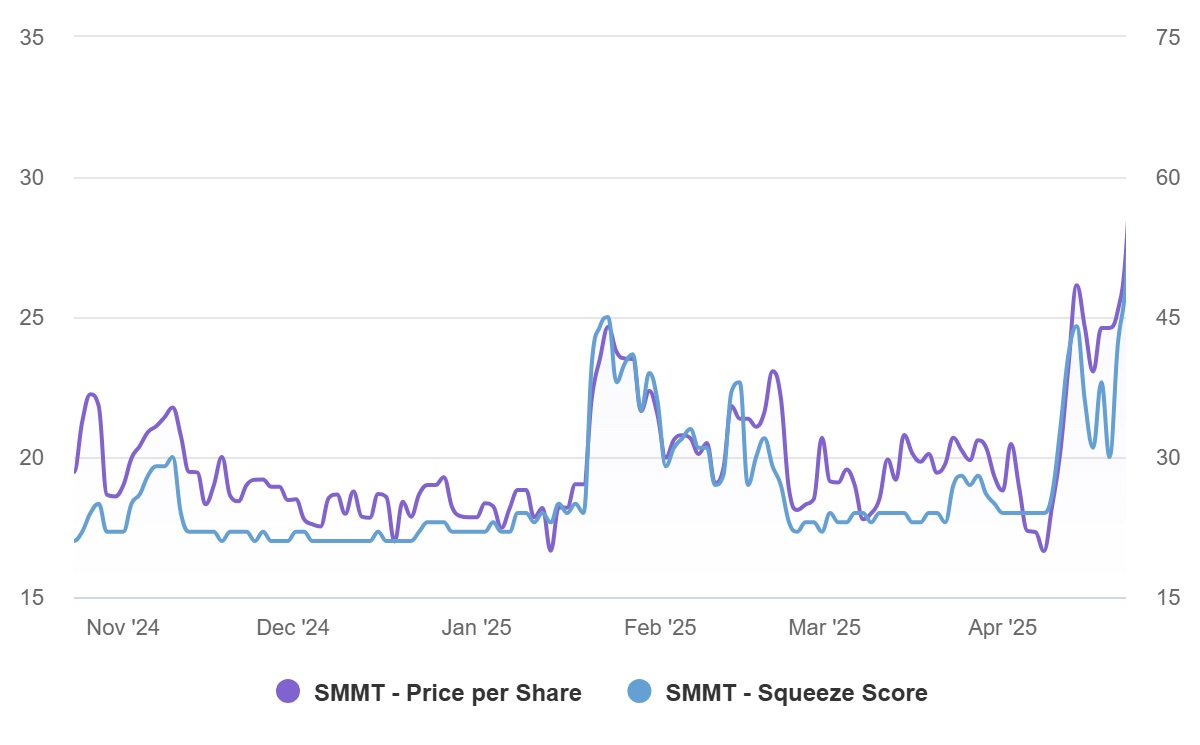

Summit Therapeutics (SMMT) currently has a short squeeze score of 66, which represents a significant increase of 43.0 points from last month. Our proprietary EquiLend Short Squeeze Score metric, which ranges from 0 to 100, measures the likelihood of a potential short squeeze by analyzing factors such as short interest, borrowing costs and price momentum. A higher score indicates increased probability of a short squeeze event. This dramatic rise in short squeeze score indicates growing pressure on short sellers.

The stock’s utilization rate of 78.98% is approaching critical levels, suggesting that available shares for borrowing are becoming scarce. Utilization measures the percentage of available shares that are currently being borrowed relative to the total lendable inventory, with higher rates indicating potential supply constraints in the securities lending market. Combined with elevated borrowing fees compared to historical averages, short sellers are facing increasing costs to maintain their positions.

The recent positive clinical trial results have driven strong buying pressure, creating a potential trigger for a short squeeze. As the stock price continues to rise, short sellers may be forced to cover their positions, further accelerating the upward price movement.

Technical Analysis

Summit Therapeutics Inc.’s stock has broken above its 50-day and 200-day moving averages, confirming a bullish trend. Volume has been increasing on up days, suggesting strong buying interest. The Relative Strength Index (RSI) is above 70, indicating strong momentum and overbought conditions but not yet at extreme levels that would signal an imminent reversal.

Conclusion

Summit Therapeutics (SMMT) presents a compelling short squeeze opportunity due to its high and rapidly increasing short squeeze score of 66 (up 43.0 points in the last month), elevated utilization rate of 78.98% and recent positive clinical trial results serving as a catalyst.

The combination of fundamental catalysts, technical breakout and deteriorating securities lending metrics suggests that short sellers are under significant pressure. Traders looking to capitalize on potential short squeeze opportunities should monitor SMMT closely, particularly for increases in trading volume and acceleration in price movement, which could signal the beginning of a more pronounced squeeze.

Contact us at https://equilend.com/services/equilend-short-squeeze-score/ to find out how you can leverage EquiLend’s Short Squeeze Score today.

Bloomberg Terminal users can subscribe to EquiLend’s exclusive Orbisa securities lending data by entering terminal shortcut APPS ORBISA <GO> or clicking the following link: https://on.equilend.com/bloomberg-terminal-page