Insight

May 2025

Bob Sheehan

Short Selling In Focus: Prescription for Profit

Pharmaceutical Stocks React in the Wake of Trump's Prescription Price Reform

Market Reaction Following Trump’s Prescription Price Reform Announcement

In the wake of President Trump’s announcement of prescription price reform, the S&P 500 Pharmaceutical Industry Index fell more than 5% over the following 3 days trailing the broader index by nearly 9% over that span. This immediate market reaction demonstrates how quickly investors responded to Trump’s policy announcement. Despite the post-announcement struggles for the Big Pharma industry, EquiLend’s short sale and financing data has shown a lack of uptick in short positioning against larger, bellwether pharmaceutical companies. Following the announcement, we witnessed long holders exit their positions, while short sellers appeared to take a “wait and see” approach rather than broadly reacting to the proposed reforms. The subdued borrowing activity in established pharmaceutical companies suggests that short sellers are not yet making a bet on the impact the price reforms may have on Big Pharma’s bottom line. Investors may view the impact of reforms as already baked into the recent price movements, indicating that shorts are not increasing positions because they believe the negative price action already reflects the overall expected impact of these policy changes.

Analysis of EquiLend’s short sale and financing data showed a more restrained market reaction to the announcements than the broader equity market. Major pharmaceutical companies like Eli Lilly (LLY) and Merck (MRK) exhibit low utilization rates of just 0.22% and 0.17% respectively, indicating minimal short selling activity. Even Amgen (AMGN), which saw borrow quantity (a strong proxy for short interest) increase from 5.1 million shares up to 7.9 million the week of May 12-16, remains well within general collateral levels, meaning shares are easy to borrow and generally have limited short interest. The muted short interest across bellwether names stands in contrast to what might be expected following a major policy announcement threatening industry pricing power. However, it’s worth noting that AMGN has experienced a notable upward trend in short interest since the beginning of 2025 according to exchange data. The rising short interest, coupled with the fact that EquiLend’s borrow quantity has steadily increased since December 2024, suggests some investors may have anticipated the recent price movements, positioning themselves accordingly ahead of market developments.

Market Implications

The lack of significant short positioning in major pharmaceutical stocks suggests that the market is discounting the immediate impact of the proposed reforms or anticipating potential modifications before implementation. On the other hand, we observed targeted positioning in smaller, more vulnerable companies within the sector. The divergence between bellwether names and smaller players indicates a nuanced market assessment that distinguishes between companies based on their scale, diversification and patent protection. As policy details emerge and the May 2025 executive order approaches, we believe this divergence in short interest and financing data within the pharmaceutical industry could provide valuable signals about evolving market sentiment and which companies are at greatest risk.

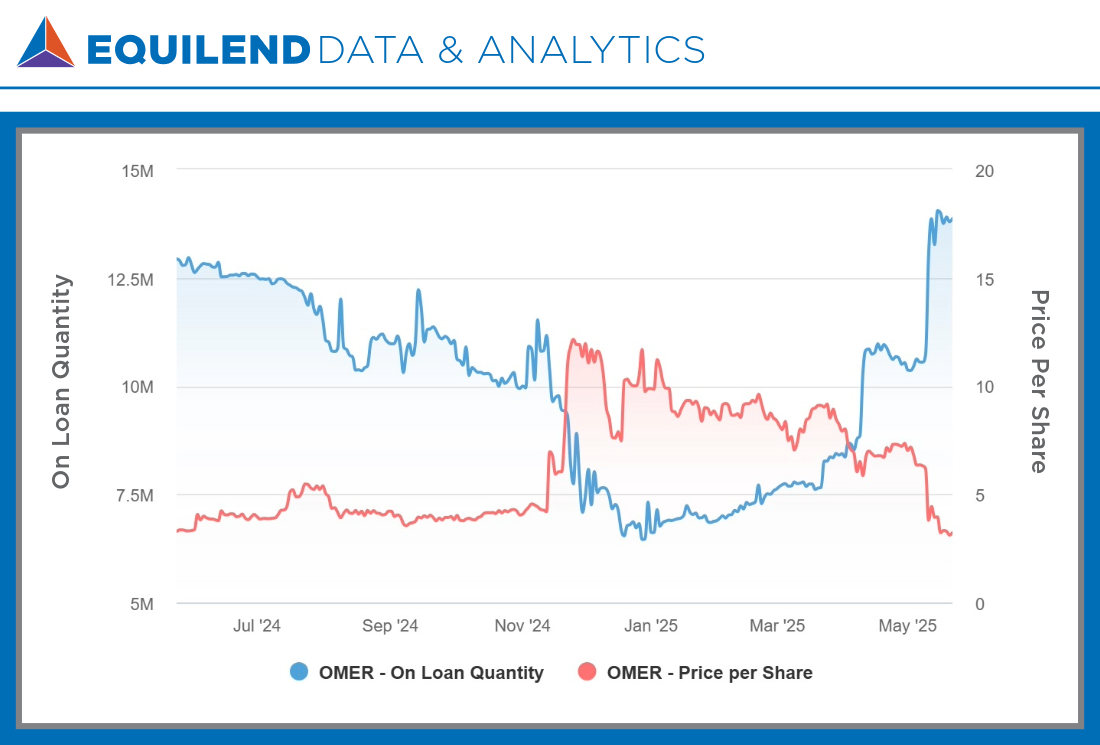

Spotlight: Omeros Corporation (OMER)

Omeros Corporation (OMER), a Seattle-based clinical-stage biopharmaceutical company, has experienced increased short interest and financing activity, highlighting its vulnerability to the proposed reforms. With a market capitalization of just $190 million and current price of $3.22, OMER shows a utilization rate of 90%, on-loan quantity of 13.9 million shares and days to cover of 11.36.

Notably, we observed utilization and borrow demand building prior to the company’s recent convertible bond announcement, with activity intensifying significantly following this news. The convertible offering, which provides potential dilution risk, has clearly accelerated short positioning, though our data indicates bearish sentiment was already building beforehand. This earlier bearish sentiment likely stems from ongoing regulatory challenges with the company’s lead drug candidate narsoplimab, which has faced a prolonged FDA approval process. The company’s March 2025 resubmission of its Biologics License Application (BLA) following previous regulatory setbacks has created uncertainty around the drug’s commercial prospects, contributing to the elevated short interest. The high days to cover ratio indicates that favorable policy developments or exemptions could cause a short squeeze, creating volatility.

Similar patterns are emerging in other small-cap pharmaceutical stocks. CytoDyn Inc (CYDY) shows a 99.9% utilization rate with 22million shares on loan and 4.9 days to cover. Phathom Pharmaceuticals Inc (PHAT) demonstrates comparable pressure with a 91.34% utilization rate and 12 million shares on loan. These elevated utilization rates across multiple small-cap pharmaceutical companies suggest that short sellers are specifically targeting smaller firms with less diversified revenue streams and greater vulnerability to pricing reform measures. Both companies face substantial short positioning that could create significant volatility should market sentiment shift.

The short sale and financing data signals for these smaller cap stocks are more substantial than those of larger pharma companies and suggests significant market positioning against smaller pharmaceutical firms. OMER serves as a “canary in the coal mine” for how the smaller companies might fare under more aggressive pricing policies, especially if a Trump administration intensifies international benchmarking measures.

Conclusion

The pharmaceutical sector is experiencing a nuanced response to Trump’s prescription price reform announcement, with EquiLend’s short sale and financing data revealing targeted positioning rather than broad bearish sentiment. The sell-off in Pharma stocks comes at the same time the broader market has rallied, possibly reflecting investor concerns about future revenue streams and pricing power. Small-cap companies like Omeros Corp. face particular challenges due to their lack of scale, diversification or strong patent protections. Investors should closely monitor short sale and financing data for early signals of sentiment shifts and potential market moves as policy details emerge.

You may also like:

The Purple

In The Purple Issue 21, EquiLend Data & Analytics shows exactly where...

Read MorePredicted Short Interest: A New Lens on Market Positioning

Understanding short interest is critical, yet traditional short interest data has significant...

Read More2025: The Year AI Reshaped the Lending Landscape

2025 was a defining year for AI-linked equities. Markets aggressively rewarded companies...

Read More