Insight

January 2026

The Purple Issue 21

Predicted Short Interest: A New Lens on Market Positioning

Understanding short interest is critical, yet traditional short interest data has significant limitations as it is infrequent and heavily delayed. Securities lending activity offers a timelier, real-time view of short positioning, making it a stronger foundation for market insight. However, borrow data alone is not definitive: not every short sale requires a new borrow, and lending volumes are also influenced by financing activity, hedging strategies and arbitrage trades. A comprehensive perspective requires looking beyond borrow data to capture the full picture.

This is where EquiLend’s NEW Predicted Short Interest offers a breakthrough. Trained on 10+ years of real-time lending dynamics, including borrow quantities, restricted and unrestricted inventory levels, borrow costs, short volume, price changes and more, our AI/ML-driven model delivers daily short interest estimates with unprecedented accuracy and timeliness. By leveraging industry-leading securities lending data and highly scalable machine learning models, we can identify true short positioning even when borrow quantities are noisy.

When Securities Lending Data Works Well

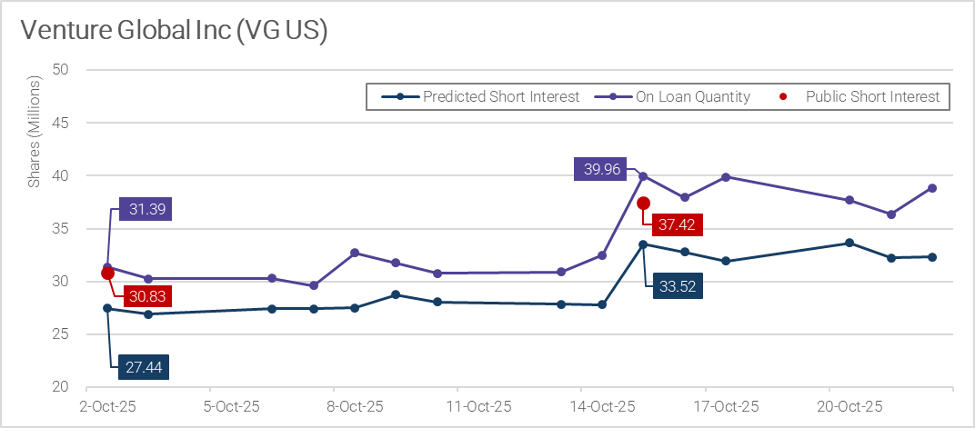

In many instances, the borrow quantity in the securities lending market is a direct substitute for traditional short interest. This is especially true for certain securities in heavy demand, known as “hard–to–borrows”. Venture Global (VG US) highlights just how closely correlated the data can be throughout moments of volatility. The stock plunged 24% on October 10 as the liquefied natural gas exporter lost a $1 billion arbitration proceeding against BP. Shares borrowed rose the following week and short interest data, published on October 24, eventually followed suit and reflected the increase. With daily totals and intraday updates to loan positions available within EquiLend’s ecosystem, securities lending data has been a welcomed complement to the infrequent and delayed short interest.

How Machine Learning Fills in the Gaps

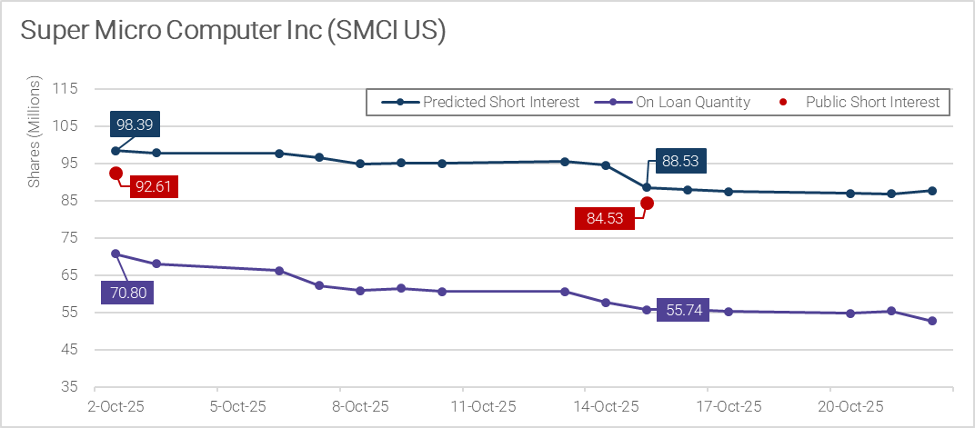

Easy-to-borrow securities and general collateral often exhibit the greatest discrepancies between borrow volumes and actual short interest, as brokers frequently satisfy short positions using internal inventory. Super Micro Computer Inc. (SMCI US) illustrates this dynamic: while directional sentiment was clear, borrow data alone proved misleading. In October 2025, the AI-focused U.S. technology company faced significant shorting pressure, yet borrow costs remained low and utilization ranged between 25% and 35%.

While being widely accessible from a lending perspective, SMCI saw an 8 million share decline in loan balances between September 30 and October 15, coinciding with a 13% price increase that squeezed shorts. Although EquiLend’s borrow data correctly signaled a reduction in short interest, the 22% decline was overstated. In contrast, EquiLend’s Predicted Short Interest model anticipated a more accurate 10% decrease to 88.53 million shares, well ahead of the official short interest publication date.

How Machine Learning Filters the Noise

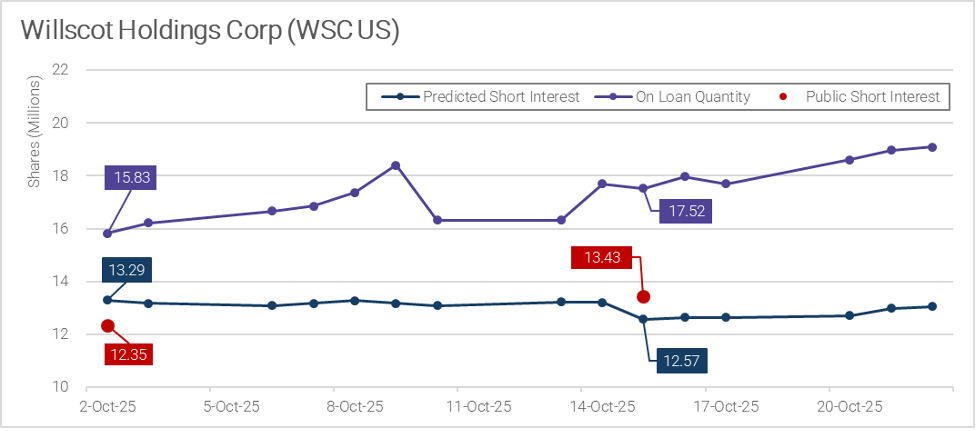

Securities lending borrow volumes often reflect factors beyond short selling, which can lead to figures exceeding actual short interest. WillScot Holdings Corp. (WSC US) provides a clear example. Despite negative sentiment driven by missed revenue and EPS targets and a high debt load, borrowed shares in the U.S.-based temporary storage provider have consistently outpaced reported short interest.

In October 2025, EquiLend’s borrow data showed significant volatility, with lows around 16 million shares and peaks over 19 million shares, all while publicly available short interest hovered around 13 million shares. The Predicted Short Interest model was trained to effectively filter out this noise, resulting in stable and closely aligned estimates with the public short interest range over the same period.

The EquiLend Advantage

In today’s markets, relying on delayed and incomplete short interest data creates blind spots that can materially impact trading, risk management and investment decisions. EquiLend’s Predicted Short Interest closes that gap. By transforming intraday securities lending signals into accurate, real-time short interest estimates, we give market participants an early, reliable view of true positioning, even when traditional borrow data is distorted by liquidity, hedging and arbitrage activity.

You may also like:

The Purple

In The Purple Issue 21, EquiLend Data & Analytics shows exactly where...

Read MorePredicted Short Interest: A New Lens on Market Positioning

Understanding short interest is critical, yet traditional short interest data has significant...

Read More2025: The Year AI Reshaped the Lending Landscape

2025 was a defining year for AI-linked equities. Markets aggressively rewarded companies...

Read More