Korean Short Selling is Back

Keith Min

May 1, 2025

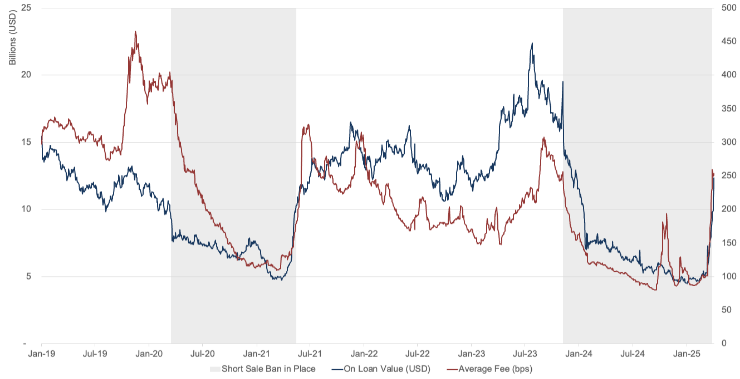

In Q1 2025, the lending of APAC equities bolstered revenue for the rest of the securities finance market by reporting a 29% increase in year-over-year revenue of $569 million. Driven by 20% rise in average fee and a 9% increase balances, the region’s growth in the lending markets proved to be extraordinary as one of its major markets, South Korea, had a short selling ban in place. But on March 31, the ban was lifted and equity lending for APAC’s third largest market by revenue, pre-short selling ban, is back in focus. With the first week of trading as a guide, here is what we can expect from the equity lending market with over $128 billion in lendable assets.

Comparing the Recent Bans

When the COVID-related ban was partially lifted in mid-2021, market sentiment for Korean equities was high. The “Donghak Ant Movement” – a surge in retail investment in tech stocks – combined with low interest rates from the Bank of Korea and strong global chip demand for semiconductors, drove the KOSPI Composite Index to unprecedented levels. These conditions presented opportunities for short sellers, even though short selling remained limited to large cap securities. The securities finance market immediately returned to pre-ban balances of $10 billion but the average fee of 311 bps trailed its pre-ban benchmark of 400 bps.

Today’s global market sentiment paints a very different picture. With tariff wars initiated by the US, weakening chip demand, political instability with a recent call to Martial Law and significantly higher interest rates, the short selling market is primed for a major comeback. With new controls and monitoring to curb naked short selling, the initial week of short selling activity brought $4.38 billion USD in short activity according to the Korea Exchange. During the short time frame, the highly correlated securities finance market’s average fee returned to pre-ban levels in the 250-bps range. While the finance market’s balance of $12 billion is still growing, we expect this to match and exceed November 2023’s figure of $19 billion USD within the next few months if current market conditions continue.

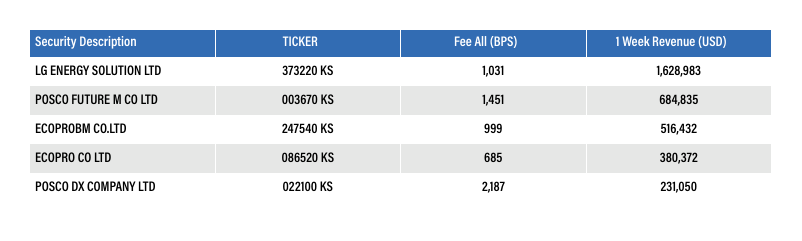

Top 2 Earners, Same Exposure

Battery-related companies were in heavy focus once the ban was lifted as the top three earners for the week shared identical fee and utilization changes. The industry has been facing major headwinds as the demand for electric vehicles declined, and the rising costs for raw materials, such as nickel, taper profitability resulting in reduced forecasts.

LG Energy Solution (373220 KS) generated the most revenue in the Korean equity lending market, lendable supply remained highly utilized with over 3.7 million shares on loan but throughout the week, the average fee for existing loans rose from 700 bps to just over 1,000 bps, drastically increasing the cost to short the security.

Similarly, POSCO Future M (003670 KS) observed a similar trend with the average fee across open positions increasing from 1,300 bps to 1,450 bps at the end of the week. With over 70% of inventory already on loan, rates are bound to escalate further as new short positions arise.

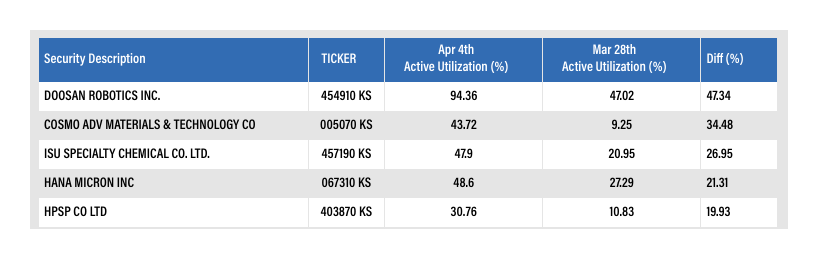

Largest Increases in Active Utilization

Once the ban was removed, Doosan Robotics (454910 KS) jumped in active utilization from 47% to 87% in a single day. The South Korean company specializing in collaborative robots for industrial applications has not reported a profit since its inception in 2015, while reporting a 13% decline in revenue year-over-year. Additionally, a failed merger with an “undervalued” Doosan Bobcat raised investor concerns for both companies’ corporate governance structure. The drastic increase in loan quantity from 336,945 on March 28 to 587,958 on March 31 suggests that short sellers have been patiently waiting to place their positions despite shares being down 40% since mid-February.

Cosmo Advanced Materials & Technology Co (05070 KS), a manufacturer and distributor of battery-related materials, observed a 34% increase in active utilization from 9% to 44% over the first week since the ban. As with the top two earners, the company faces sector headwinds with declining EV demand and increasing raw material costs, which saw its stock price fall by 26% since the beginning of the year. Shares are still available within the securities finance market but with other battery-related companies fully utilized, Cosmo Advanced Materials & Technology should expect increased demand as shorts pivot to similar securities within the same sector.

Just five years ago, equities in the APAC region accounted for 27.5% of the total equity revenue of Q1 2020. In the first quarter of 2025, that market share increased by just under 7% to 34.3% of total equity revenue. With all major markets experiencing volatility, the full return of short selling should bolster the Korean and APAC securities lending markets to new levels for the industry.