Next Generation Trading (NGT)

NGT offers unparalleled liquidity in the securities finance market

Next Generation Trading (NGT) is a multi-asset class trading platform for the securities finance marketplace. Accessed through NGT’s intuitive, Web-based user interface or via full automation using our proprietary messaging protocol, NGT offers access to global securities finance trading to firms of all sizes.

With tens of thousands of trades conducted on the platform around the globe each day, NGT offers unparalleled liquidity in the securities finance market. NGT’s strategic features increase trade-level transparency, improve workflow automation and generate efficiencies market wide. Navigate the complexities of the market with NGT, built to simplify, optimize and revolutionize your trading.

NGT Client Testimonials

Head of Global Securities Finance, Wedbush Securities

Ensure T+1 Readiness with EquiLend

Key Stats

Firms using NGT globally each day

NGT active in

markets

Average daily notional traded on NGT as of June 2025

The highest recorded trades in a single day (April 7, 2025)

Notional: highest notional traded in a single day on NGT on June 23, 2025

Domiciles of assets traded

NGT Features

T+1

Ready

NGT is available 24 hours a day for real-time securities lending trading between lenders and borrowers, including traditional stock loan and fixed income lending as well as to cover settlement fails. New counterparties benefit from free onboarding and integration.

Auto

Response

For screen lenders, the NGT user interface may be configured to have trades be automatically accepted, or rejected based on user-supplied parameters

Integration with

ECS for CCP Trades

NGT is connected to EquiLend Clearing Services (ECS) to facilitate CCP trades via various Central Counterparties

Robust STP Capabilities

NGT offers a full set of messaging protocols to allow clients to connect to the NGT engine for straight-through processing capabilities

Regulatory Point

of Trade Execution

EquiLend SFTR offers clients full SFTR support with UTI generation and execution time stamp at the point of trade.

Ease of Integration

NGT offers various ways for clients to connect into the eco-system. An intuitive web-based interface allows for traders to transact over the platform, providing a best-in-class user experience while going about their day-to-day trading activities. This includes a real time Order Book, Trade Blotter and a robust series of filters and screen downloads.

For clients who prefer Straight-Through Processing (STP), EquiLend offers a full set of messaging protocols to connect straight into the NGT engine. Borrow requests, Trade offers, execution and trade bookings can all be fully integrated into our clients’ proprietary systems, combining the power of NGT and our clients’ systems for a seamless front-office workflow solution.

NGT is designed and built for full interoperability between the different modes of integration, meaning clients can be fully agnostic to how their counterparties use NGT.

Monthly Trading Volumes

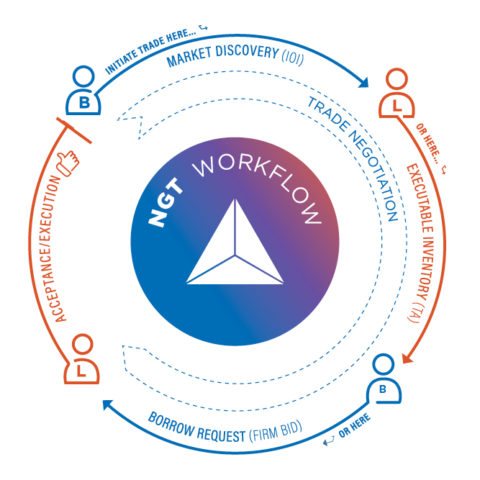

Multiple Entry Points Into The NGT Eco-System, Catered To Your Borrowing And Lending Needs:

Targeted Availability - Unprecedented Transparency and Liquidity

NGT’s Targeted Availability workflow delivers transparency to inefficient market processes. Targeted Availability increases the correlation and relevance between Offers and Bids. Lenders actively publish executable inventory, visible to borrowers, who respond to Targeted Availability resulting in higher execution rates and dual benefit to lenders and borrowers. Lenders realise higher asset utilization, while borrowers fill their needs more efficiently

Indications of Interest -

Market Discovery

Borrowers can reach out to multiple lenders to communicate interests for securities. NGT’s Indication of Interest (IOI) functionality uses a proprietary Natural Language Processing (NLP) algorithm to efficiently process emails, standardizing it into a system-readable format for lending counterparts

Firm Bids – Low Touch General

Collateral (GC) Trading

Borrowers can also choose to initiate firm borrow requests to their lending counterparts via NGT for their daily GC borrowing needs. NGT’s messaging capabilities allow for counterparties to communicate seamlessly with one another for a fully automated borrow and lending workflow, system to system

NGT Chains

Borrowers have the ability to set up a pre-defined order of lenders they want to transact with, and allow NGT to route borrow requests sequentially, eliminating the need for the borrowers to send in multiple lists and preventing over-borrows.

Competitive Bid

A hybrid workflow for the hard-to-borrow market, leveraging Real-Time Data and Post-Trade insights within NGT to centralize and enhance trading decisions.

Linking It All Together

The various NGT features allow clients the flexibility to pick and choose the different workflows that cater to their needs. For example, clients can use the IOI and Targeted Availability features to negotiate the warm and hard-to-borrow names, while using the Firm Bid feature to handle their GC transactions with their counterparts