Securities Financing Transactions Regulation (SFTR)

Ensure SFTR Compliance with Confidence

EquiLend’s flexible SFTR solutions help firms meet their regulatory obligations with confidence. Built on 20-years of expertise in securities finance technology, our solutions are designed specifically to support broker-dealers, agent lenders and buy-side firms with accurate, efficient and future-proof SFTR reporting.

EquiLend operates EquiLend NGT , the industry’s most active securities finance trading platform, and a full suite of post-trade services , including our flagship Unified Comparison tool, the nucleus for post-trade lifecycle management and a gateway into all the other PTS products available within EquiLend. This comprehensive foundation enables us to deliver point-of-trade reporting, enriched data and end-to-end compliance workflows effectively.

Solutions

Not all firms are alike, and SFTR solutions are most certainly not one-size-fits-all. Depending on your firm’s needs, we offer a range of solutions designed to fit your firm’s needs.

1. UTI Sharing - NGT Based

A light-touch solution that shares UTI and SFTR trade data at point of trade via NGT.

Why it’s valuable:

- Fast setup leveraging existing NGT connectivity

- Counterparties receive reporting data immediately at point of trade

- Ideal for firms who already have a reporting solution but need UTIs generated and shared in real tim

2. UTI Sharing & Data Enrichment

EquiLend enriches, pairs and reconciles trade data using internal business rules, producing outbound files with all reportable data elements, including allocations, ready for SFTR reporting.

Why it’s valuable:

- Lifecycle events fully supported

- Data enrichment and reconciliation built in

- Supports Agent Lender flow

- Strong fit for firms seeking reliable matching and enrichment while retaining reporting control

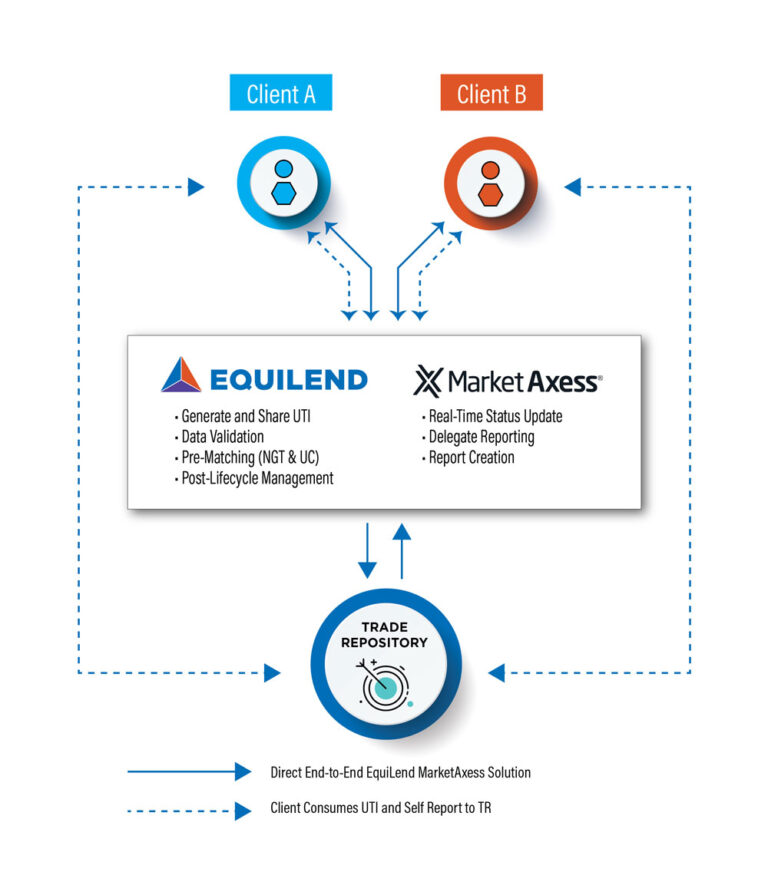

3. End-to-End Solution with MarketAxess including Full Trade Repository Submission

Together with MarketAxess, EquiLend offers a fully automated STP solution from trade ingestion to submission at the trade repository, powered by EquiLend data enrichment and MarketAxess’ Insight engine.

Clients will benefit from a complete automated SFTR reporting workflow that ensures accuracy, transparency and seamless exception management.

Why it’s valuable:

- Fully automated end-to-end reporting

- Dual-layer data enrichment from EquiLend and Market Axess ensures data completeness and accuracy

- Exception handling and submission tracking in a single dashboard

Benefits

-

ESMA-compliant UTI and execution timestamps auto-generated and shared at point of trade, the earliest stage for SFTR reporting

-

Loan allocations shared at point of trade, providing UTI and execution timestamps on underlying principal funds and beneficial owners

-

100+ trading client base, offering maximum access to the securities lending and repo community

-

A fully automated front-to-back SFTR reporting solution: trades booked on NGT can be subsequently auto-enriched via SFTR Insight with relevant data fields and reported within minutes to the trade repository

-

Reconciliations on trades show an average break rate of less than 1% across the lifecycle for transactions executed on NGT versus a 35% break rate for transactions executed off platform

-

Prepares clients for evolving reporting frameworks and seamless upgrades to accommodate future ESMA-driven changes (2025 Call for Evidence)

Future-Proof Your SFTR Reporting

EquiLend’s SFTR solutions give your firm the confidence to meet reporting requirements while removing the operational drag of manual processes. With connectivity to more than 100 counterparties, enrichment tools that dramatically cut reconciliation breaks and the option to integrate seamlessly with MarketAxess for full STP reporting, clients can choose the level of automation that works for them now and scale when they’re ready.

Partner with EquiLend to simplify your SFTR workflow, reduce risk and stay ahead of regulatory change.