EquiLend Insight

Read our latest industry insights, opinions and product solutions.

EquiLend Trading Solutions

Monthly Updates

monthly take on trading data and market movements.

Market Flash

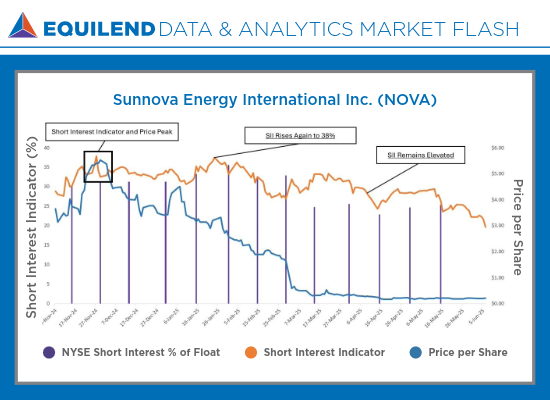

Market Flash on NOVA

EquiLend Data & Analytics surfaced elevated short interest in NOVA, averaging 28.8%,...

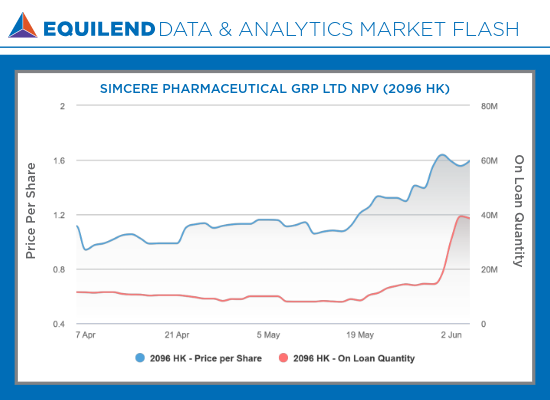

Read MoreMarket Flash on SIMCERE

This Hong Kong-listed pharmaceutical stock climbed 30% in 3 weeks — yet...

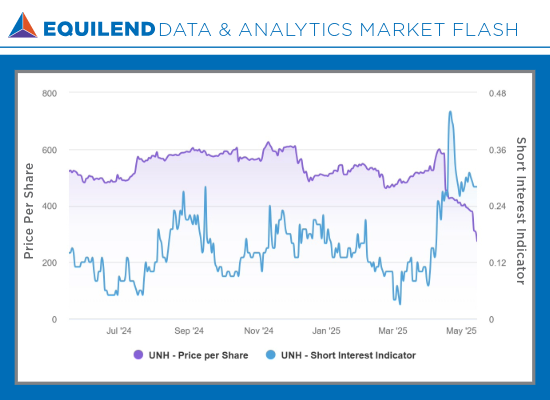

Read MoreMarket Flash on UNH

UnitedHealth Group (TICKER: UNH) shares fell from $600 on April 11 to...

Read MoreInsights

Monthly Securities Finance Market Review: June 2025

Insight June 2025 Mike Norwood Monthly Securities Finance Market Review: June 2025...

Read MoreFully Paid Lending with EquiLend Spire

As part of the EquiLend Spire suite of Securities Finance Platform Solutions,...

Read MoreMonthly Securities Finance Market Review: May 2025

EquiLend’s Head of Trading Solutions, Mike Norwood, shares his global monthly market review...

Read MoreShort Selling In Focus: Prescription for Profit

In the wake of President Trump’s announcement of prescription price reform, the...

Read MoreMonthly Securities Finance Market Review: April 2025

EquiLend’s Head of Trading Solutions, Mike Norwood, shares his global monthly market review...

Read MoreNick Delikaris Looks Ahead to A New Chapter in Securities Finance

Nick Delikaris lays out his vision for securities finance powered by advancing...

Read MoreSEC Rule 10c-1a Frequently Asked Questions

Our 10c-1a FAQ dives into components of the rule, implementation, timelines and...

Read MoreQ1 2025 Review

The first quarter of 2025 was a period of heightened volatility and...

Read MoreLeveraging Securities Finance for Corporate Short Interest Insights

Navigating short interest in the corporate bond market can be filled with...

Read MoreKorean Short Selling is Back

In Q1 2025, the lending of APAC equities bolstered revenue for the...

Read MoreThe Purple

In this edition, we explore Q1 2025 securities lending trends, spotlight APAC's...

Read MoreGetting SSI-Ready for T+1 in Europe: FMSB Recommendations for a Seamless Transition

An analysis of the recommendations, challenges and opportunities of automating SSIs, from...

Read More