A Day in the Life of: David Field

A Q&A with David Field, Founder and Managing Director, The Field Effect

January 2026

A Q&A with David Field, Founder and Managing Director, The Field Effect

Discover how to access China’s capital markets and the potential for securities lending. Learn more now!

Some firms are reinventing themselves, apparently capitalizing on the market’s fervent enthusiasm for all things blockchain. The securities lending market appears to be skeptical.

A Q&A with Craig Donohue, Executive Chairman & Chief Executive Officer, OCC

Bitcoin’s spectacular rise in value relative to government-issued centralized currencies has dominated headlines in the past year.

Delve into the Asia-Pacific securities finance landscape: H1 2017 saw a 17% revenue drop, reflecting shifts in the regional market.

Discover why EMEA saw a revenue decrease in securities lending in H1 2017. Learn more!

Gain insights into the securities finance market in the Americas. Explore the latest trends and data now!

The robust ETF lending market in the U.S. eclipses a nascent market in EMEA and Asia. DataLend examines the global ETF landscape

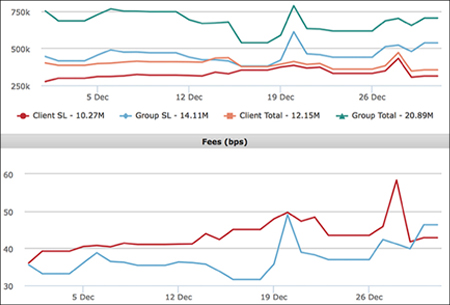

While the securities finance industry has become considerably more transparent than it was a decade ago with the advent of specialized data providers such as DataLend, the critical metrics that market participants monitor on a daily basis are still relatively unknown outside the institutional marketplace.

For all parties involved in securities lending, transparency has become increasingly important to ensure that optimal value is extracted from lending programs.

A Q&A with John Arnesen, Global Head, Agency Securities Lending, BNP Paribas Securities Services.

Consultants specializing in working with firms to optimize their lending programs discuss how their beneficial owner clients are making the most of securities finance market data.

Hard-to-borrow securities, also known as specials, make up a considerable percentage of the securities lending market’s revenue, but the 2017 global equity market rally has had a negative impact on the specials market thus also reducing lending revenue. DataLend investigated how the reduction of specials in the market has impacted global revenues over the past 18 months.

While SFTR presents challenges for lenders, the regulation also raises an opportunity to reform, and streamline, global trading models.

A Q&A with Don D’Eramo, Managing Director and Global Head of Securities Lending, RBC I&TS.