Insight

April 2025

Keith Min and Thomas Ashton

EquiLend’s Short Squeeze Score: Stay Ahead of the Squeeze

If 2021 taught the investing public anything, it’s that the potential of a short squeeze can easily outweigh the returns of a short position. Retail investors sent GameStop and other companies to the moon, pushing short sellers to their limit by forcing them to buy back shares to close their shorts which drove prices even higher. The new EquiLend Short Squeeze Score is designed to provide early warning signals of potential short squeezes, enabling short sellers and market participants to proactively mitigate risk and protect their portfolios.

The Short Squeeze Score is available across more than 50,000 unique equities in EquiLend’s suite of Data & Analytics Solutions, including DataLend, Orbisa and the Orbisa app on Bloomberg. The score incorporates existing data elements used by short sellers today combined with comprehensive securities finance data from EquiLend’s ecosystem. The score considers industry-wide P&L, demand ratios and other metrics to incorporate changes in liquidity and borrow cost within the securities finance market. Crucially, the Short Squeeze Score uses social media sentiment data to tap into the same sources that drove the major short squeezes of 2021.

The EquiLend Short Squeeze Score is built on a scale of 0 to 100. Scores between 0 and 30 identify a negligible or low probability of a squeeze event. Scores between 30 and 60 identify a medium probability of a squeeze event, suggesting market conditions in this security should be monitored. A high probability of a squeeze event would be classified with a score of 60 to 100, indicating to investors that immediate action is needed to mitigate risk.

The score is calculated daily for users to proactively adjust their strategies ahead of a significant market event and offset potential losses. Below are a handful of recent examples where the EquiLend Short Squeeze Score warned of potential short squeezes.

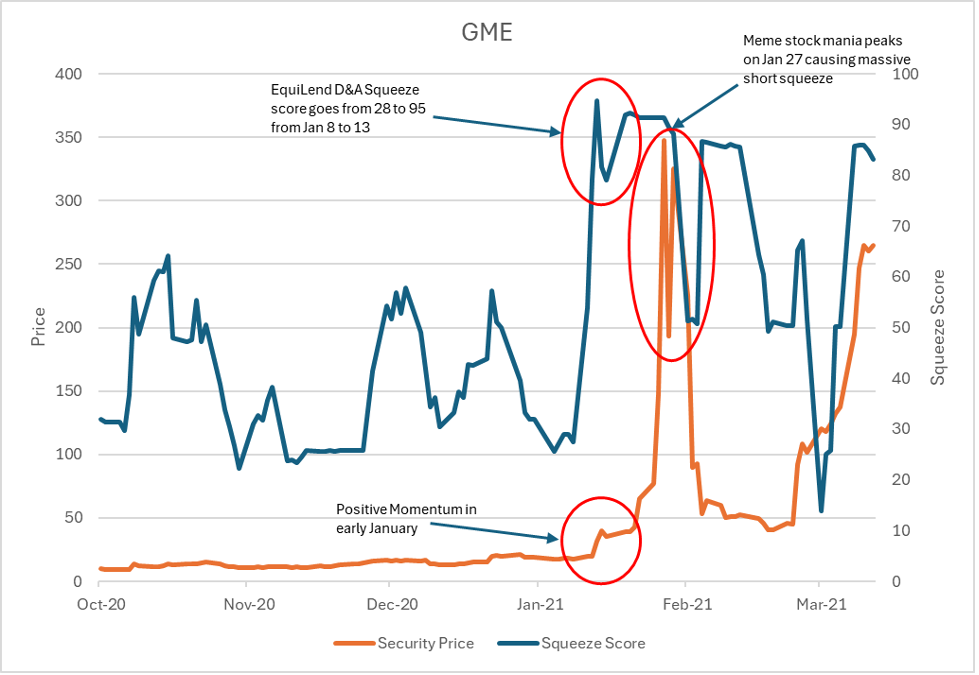

Historic Short Squeeze: GameStop (GME US) in 2021

The GameStop short squeeze in early 2021 became a landmark financial event, highlighting the power of retail investors and the complexities of modern market dynamics. Social platforms, like the subreddit r/wallstreetbets, identified an unusually high short interest and began to aggressively buy into the stock, driving the price up and creating a feedback loop of increasing demand and price.

The EquiLend Short Squeeze Score saw this massive market event coming two weeks prior to the meme stock mania peaking. In early January, GME saw modest positive price momentum; the price uptick, coupled with high short interest and extremely high demand in the securities lending market saw EquiLend’s Short Squeeze Score increase from 28 to 95 over the period of January 8 to the 13. This early warning sign, two weeks before the peak of meme stock mania, would have alerted investors to the larger squeeze and provided them with ample time to adjust portfolios and potentially avoid massive losses.

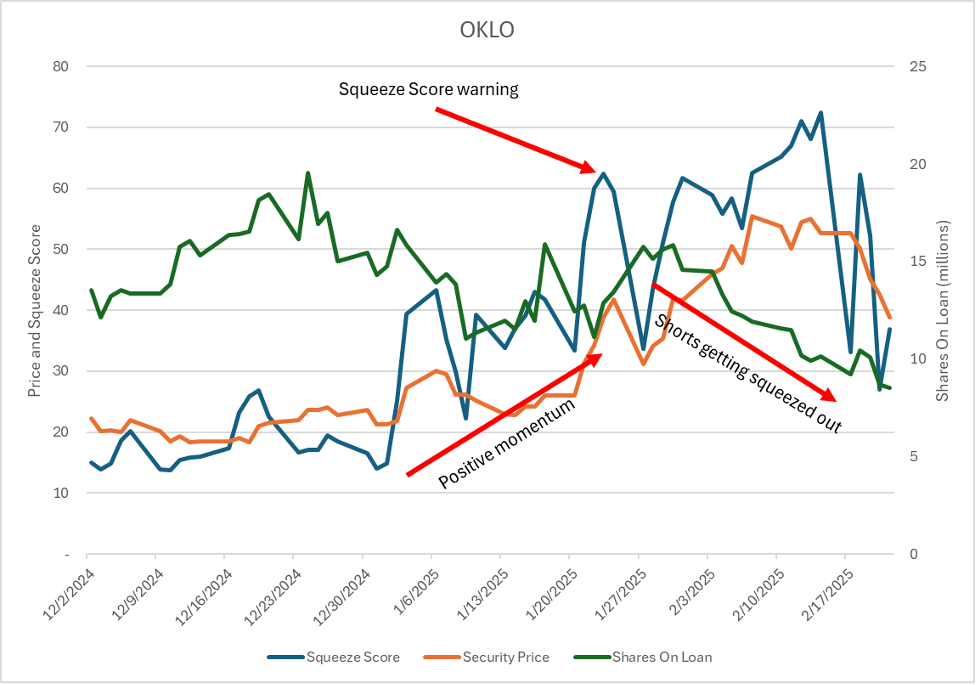

Recent Observations: Oklo (OKLO US) in 2025

A more recent example of a short squeeze was observed in early 2025 with Oklo Inc. (OKLO US) a clean energy company. The company saw rising short interest and borrow demand in the securities financing industry throughout 2024 which peaked in December after some positive news saw its stock price continue to rise.

In January of 2025 that positive momentum only continued and while some shorts closed out, the name remained crowded and EquiLend’s Short Squeeze Score more than doubled increasing to 62 from 20 on January 23. Oklo’s price continued to rise into February under the hopes that the U.S. energy sector would benefit under the new administration. This price jump saw short positions close out at a loss as short interest dropped as well as EquiLend’s shares on loan, which went from 15+ million to 8.5 million shares.

By monitoring EquiLend’s Short Squeeze Score an investor would have identified the increasing risk a month ahead of the squeeze. An investor could have closed out the position prior to the squeeze.

Don’t be caught short–incorporate EquiLend’s Short Squeeze Score into your data and analytics to manage your positions with additional market intelligence.

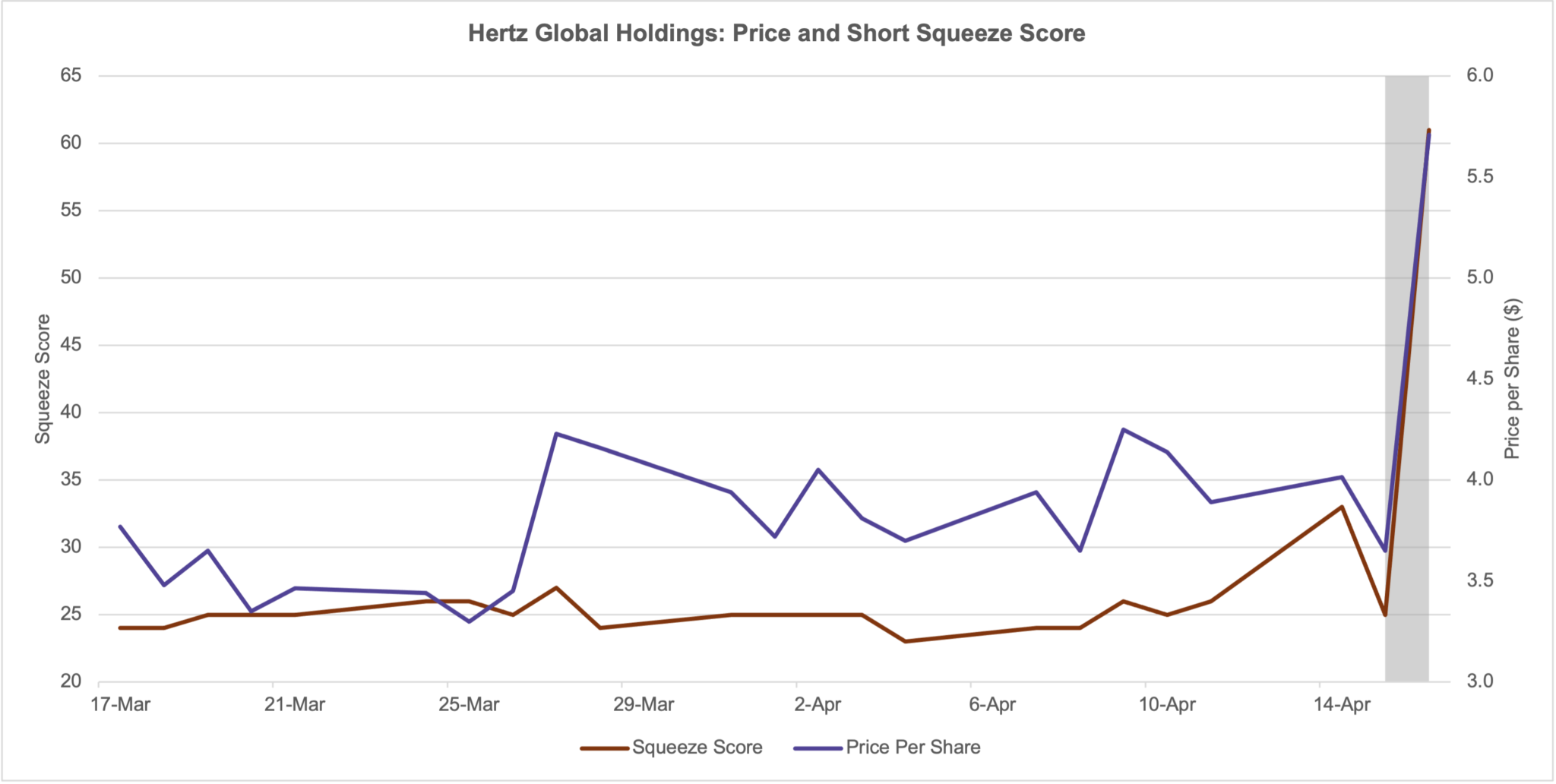

Recent Observations: Hertz Global Holdings (HTZ) in 2025

Another recent example of a short squeeze was observed in April 2025 with Hertz Global Holdings (HTZ), a rental car company. The company experienced a significant price surge of over 56% in a single day, with its stock price reaching $5.71. The catalyst for this movement was the disclosure of a 4.1% stake by Bill Ackman’s Pershing Square Capital Management. Prior to this event, Hertz had been facing challenges including fleet management issues, increased competition and elevated debt levels.

EquiLend’s Short Squeeze Score for Hertz had reached 61 (jumped 36 points in a single day), placing it among the highest-ranked short squeeze candidates in our screening universe. The stock broke through several key resistance levels on massive volume, demonstrating the powerful impact of activist investor involvement in heavily shorted stocks. The combination of high short interest and a credible investor taking a significant position created ideal conditions for a short squeeze.

By incorporating EquiLend’s Short Squeeze Score into their workflow, investors would have identified Hertz as a high-risk short position before the squeeze occurred. This case further demonstrates the value of incorporating EquiLend’s Short Squeeze Score into investment decision-making processes to manage risk effectively.

Contact us at https://equilend.com/services/equilend-short-squeeze-score/ to find out how you can leverage EquiLend’s Short Squeeze Score today.

You may also like:

The Purple

In this edition, we explore Q1 2025 securities lending trends, spotlight APAC's...

Read MoreImpact of Rate Cuts on Securities Lending

After aggressively hiking interest rates to a 10-year high of 5.5%, the...

Read MoreThe Initial Impact of the 2024 U.S. Election on Securities Lending

With two months now elapsed since the 2024 U.S. presidential election, policy...

Read More