Insight

May 2025

10c-1a FAQ

SEC Rule 10c-1a Frequently Asked Questions

Introduction to 10c-1a

1. What is the purpose of SEC Rule 10c-1a?

This rule aims to increase transparency in the securities lending market by requiring covered persons to report the material terms of their securities lending transactions to FINRA.

2. When does the rule come into effect?

The current compliance date for 10c-1a is expected to be January 2, 2026.

However, on April 29th, 2025, FINRA formally submitted a request to the US Securities and Exchange Commission (SEC) requesting an extension of the compliance date to the Rule 10c-1a, which requires covered persons to report covered securities lending trades to the authority. The SEC has not yet responded to this request for an extension.

In this submission, FINRA has requested the compliance dates be extended until September 28th, 2026 (about a nine month extension) for clients to report into FINRA, and a second extension date until March 29th, 2027 (about one year from the original date) for FINRA to publicly disseminate the collected data out to the public.

3. What information needs to be reported?

Covered persons must report covered securities loans and details for the reportable securities, including loan start and end dates, quantities of securities loaned, interest rates, fees, collateral details and counterparty information.

4. How often do I need to report?

The final rule requires end-of-day reporting by the trade date to a designated Registered National Securities Association (RNSA), currently FINRA.

5. What is SLATE?

SLATE (Securities Lending and Transparency Engine) is the platform that FINRA plans to implement for the reporting of securities lending transactions under 10c-1a. SLATE will operate alongside other FINRA transaction reporting platforms such as CAT (Consolidated Audit Trail).

6. What was the SEC decision on August 5, 2024?

The Securities and Exchange Commission announced that it is postponing its decision on the approval of FINRA’s 10c-1a SLATE proposal. This postponement will enable an extended comment period and a thorough review by the SEC.

Key Definitions

1. Who are considered “covered persons” under the rule?

The rule applies to broker-dealers, agent lenders and certain other participants involved in securities lending transactions.

Any person that agrees to a covered securities loan on behalf of a lender or as a lender is considered a covered person. Broker-dealers are also considered a covered person when borrowing fully paid or excess margin securities.

2. What is a Covered Securities Loan?

A covered securities loan is a transaction in which any person on behalf of itself or one or more other persons lends a reportable security to another person.

3. What constitutes a Reportable Security?

A reportable security is considered any securities reportable under Consolidated Audit Trail (CAT), Trade Reporting and Compliance Engine (TRACE) or Real-Time Transaction Reporting System (RTRS). These can be understood broadly as any securities denominated in USD or securities that settle in the U.S.

4. What is the jurisdiction of 10c-1a reporting?

The SEC is of the view that the rule’s reporting requirements will generally be triggered whenever a covered person effects, accepts or facilitates (in whole or in part) in the U.S. a lending or borrowing transaction.

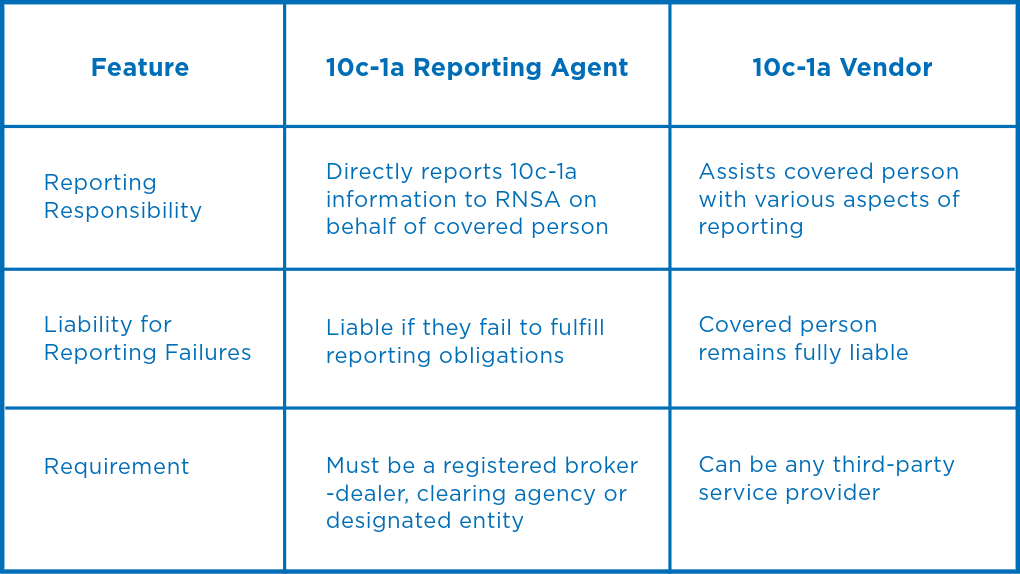

5. What is the difference between a 10c-1a vendor and a 10c-1a reporting agent?

6. What are the main exemptions or exceptions to 10c-1a reporting requirements?

Most securities lending transactions are covered, but key exceptions include:

- The use of margin securities by broker-dealers.

- Positions resulting from clearing services.

Repurchase agreements (repos), which are specifically out of scope.

7. What are the key dates for 10c-1a reporting?

10/13/2023

Regulation Release

1/2/2024

Final Rule 10c-1a Becomes Effective

5/1/2024

FINRA Implementation Proposal

8/5/2024

SEC Action on FINRA Requirements

1/2/2025

FINRA Proposed Rule in Effect

7/1/2025

FINRA UAT Period Opens

1/2/2026

Regulation Go-Live

4/2/2026

FINRA Public Reporting Go-Live

Implementation

1. Do I need to report modifications to existing trades?

Yes, the rule requires reporting both new and modified loan agreements with the timestamp of when the new trade and modifications occurred. Pre-existing trades (pre-Jan. 2, 2026) should be reported with the latest terms of the trade the first time after Jan. 2, 2026, that a modification to that trade appears.

2. What is the process for reporting modifications and corrections in SLATE?

- Modification Events: Reporters must submit only the modified fields required to be submitted, along with key linkage fields and the date and time of modification.

- Correction Events: Reporters must submit only the updated fields required to be submitted, in addition to key linkage fields.

In-scope firms should become familiarized with the rule’s requirements and begin exploring solutions to streamline data collection and reporting. Consider technology solutions like EquiLend’s platform designed to assist with 10c-1a compliance.

5. Where can I find additional information and updates?

The SEC website (https://www.sec.gov/news/press-release/2023-220) provides access to the final rule text, FAQs and other resources. Additional information can be found at the FINRA website https://www.finra.org/filing-reporting/slate. You can also stay informed by attending industry webinars and conferences and engaging with industry associations. Make sure to visit our webpage at https://equilend.com/services/sec-rule-10c-1a/ for a side-by-side comparison between 10c-1a and SFTR, key dates for 10c-1a reporting, exclusive insights and more.

6. What about “omnibus” versus “allocation” trades?

Allocation-level detail, including beneficial owners and their respective securities quantities, is required under the FINRA SLATE proposal.

7. What if I have missing historical data for pre-existing trades?

The FINRA technical guidelines provided clarification on how to handle situations where historical data for pre-existing trades is unavailable. This may involve default data values or exemptions for specific scenarios.

8. How will Unique Trade Identifies (UTIs) be provided?

UTIs (also known as FINRA Loan IDs) will be generated and provided by FINRA.

9. What are the operating hours for submitting reports to the SLATE system?

Firms can submit reports to SLATE from 6:00 a.m. until just before midnight (11:59:59 p.m.) Eastern Time on business days. Submissions outside these hours will not be accepted and must be resubmitted during the next reporting window.

10. How are late or after-hours loan events handled in SLATE?

If a loan event happens before 7:00 p.m. on a business day (Day T), it must be reported that same day before the system closes. Events after 7:00 p.m. aren’t due until the following business day. For transactions that take place on weekends, holidays, or any day SLATE is unavailable, reporting must occur on the next available business day during operating hours.

What are the benefits of using EquiLend to support your reporting requirements?

1. Seamless integration with existing EquiLend products to leverage transaction and position data (OneFile, SFTR, Spire, etc.), existing processes and more.

2. User-friendly dashboard to manage reporting & exception handling

3. Continually delivering quality regulatory products with timely updates when revised regulations are published

For any clients still interested in joining our 10c-1a working group, please get in touch with us at [email protected] or speak to your client relationship manager.

This FAQ is intended to be informative and does not constitute legal advice. Please refer to the official SEC rule text and consult with legal counsel for specific questions and guidance on compliance.