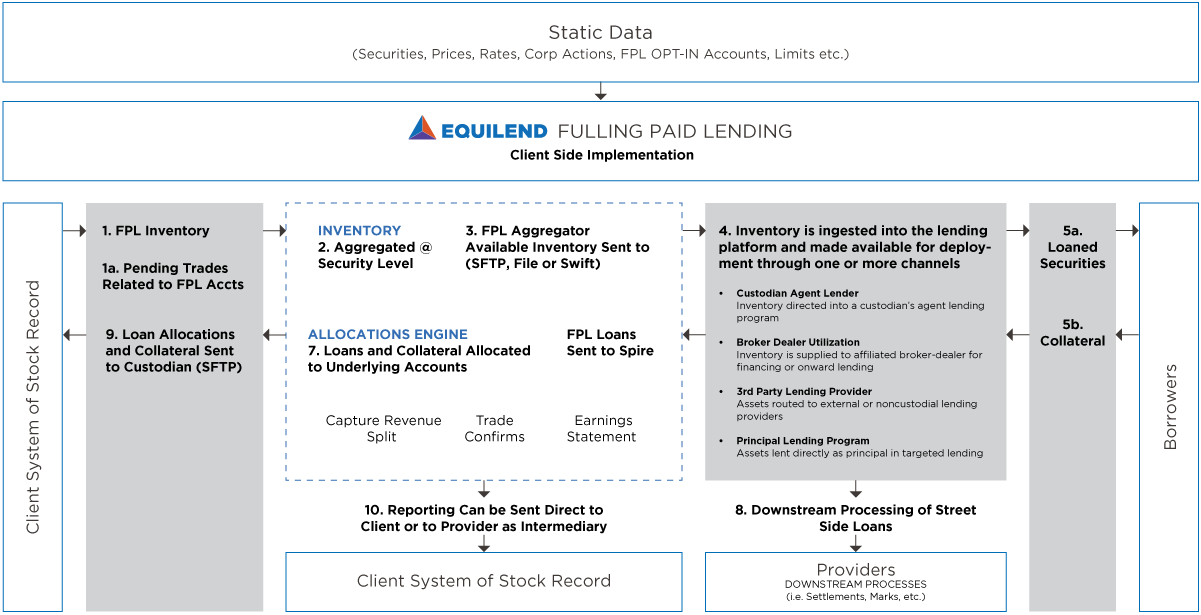

Fully Paid Lending with EquiLend Spire

As part of the EquiLend Spire suite of Securities Finance Platform Solutions, EquiLend’s Fully Paid Lending (FPL) system delivers a comprehensive FPL engine to firms which offer FPL as a service, as well as a full-fledged solution for those looking to start an FPL offering.