6 Months of Accelerated Settlement T+1 Webinar

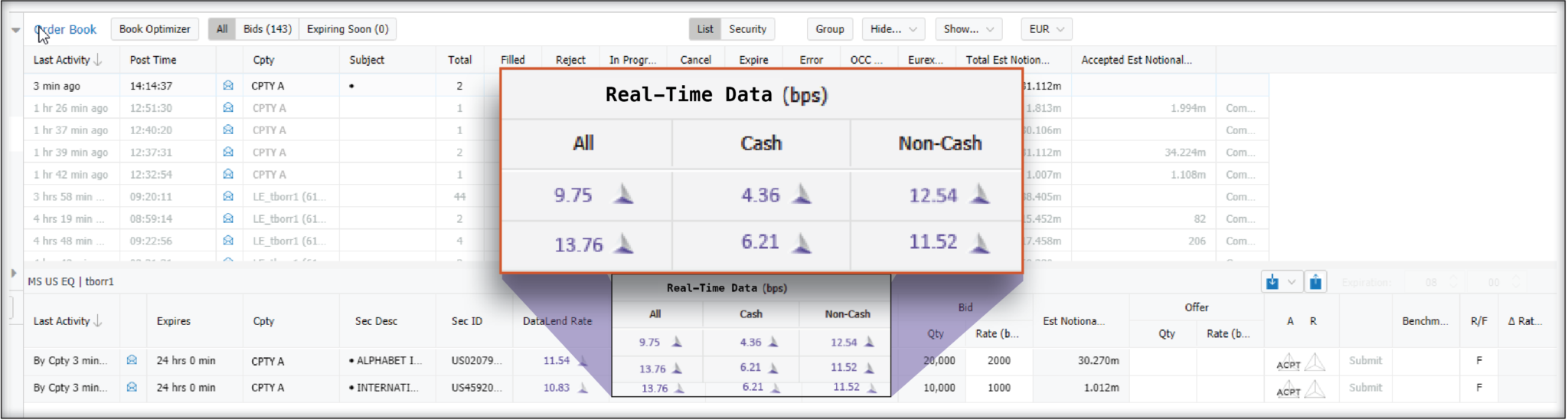

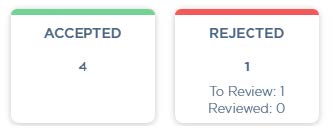

our 6 months of Accelerated Settlement T+1 Webinar covered key findings from 6 months of accelerated settlement and the detail around the challenges facing EMEA in the transition and touched on client feedback and sentiment this year in adapting to T+1.

![AdobeStock_605385825-[Converted] AdobeStock_605385825-[Converted]](https://equilend.com/wp-content/uploads/elementor/thumbs/AdobeStock_605385825-Converted-qefzikdnmz06pqapbajumtrsxjwpoyf1u9vnmadjh4.jpg)